The Credit Card Duo That Every Traveler Needs!

I often get asked what I recommend for the best credit card for people wanting to travel more frequently and for less money. There is one particular card that I think everyone should have and use. However, to really maximize building and using some of the most valuable points out there, the best strategy is actually a combination of two cards. By utilizing the Chase Sapphire Preferred and the Chase Freedom credit cards, you will certainly be on your way to obtaining more experiences for far less money than usual.

THE VALUE IN CHASE ULTIMATE REWARDS POINTS

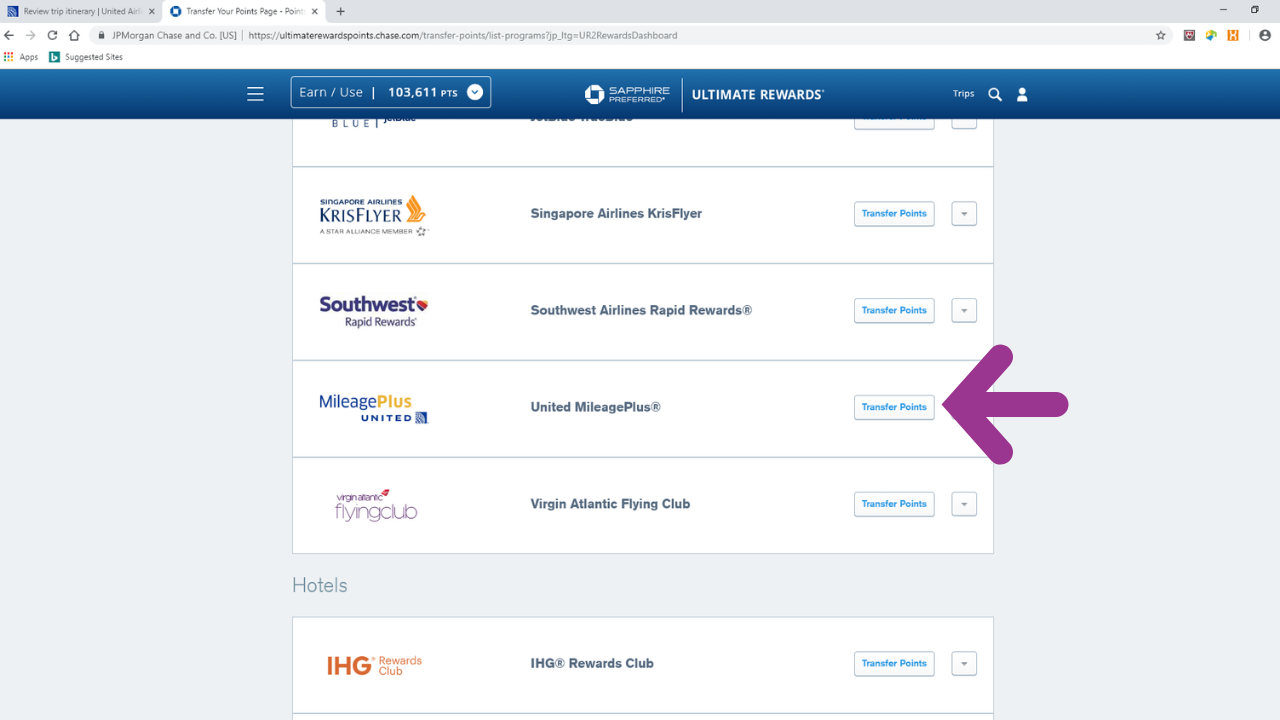

Chase Bank has its own rewards program with its own type of points. These points are called Chase Ultimate Rewards Points. Currently, it is known in the miles and points world that these particular points are extremely valuable. They are highly sought after and hold this reputation due primarily to the fact that these points are “transferable”. Typically, most points out there only allow you to redeem for one organization. For example, if you get a Delta Airlines credit card, you can only use those points to book flights on Delta Airlines. Chase Ultimate Rewards points, on the other hand, can be transferred to multiple different airlines and hotel chains. Here is a current list of Chase transfer partners (at the time of writing this post):

- United MileagePlus

- Southwest Airlines Rapid Rewards

- British Airways Executive Club

- Flying Blue AIR FRANCE KLM

- Singapore Airlines KrisFlyer

- Virgin Atlantic Flying Club

- Hyatt Gold Passport

- IHG Rewards Club

- Marriott Rewards

- The Ritz-Carlton Rewards

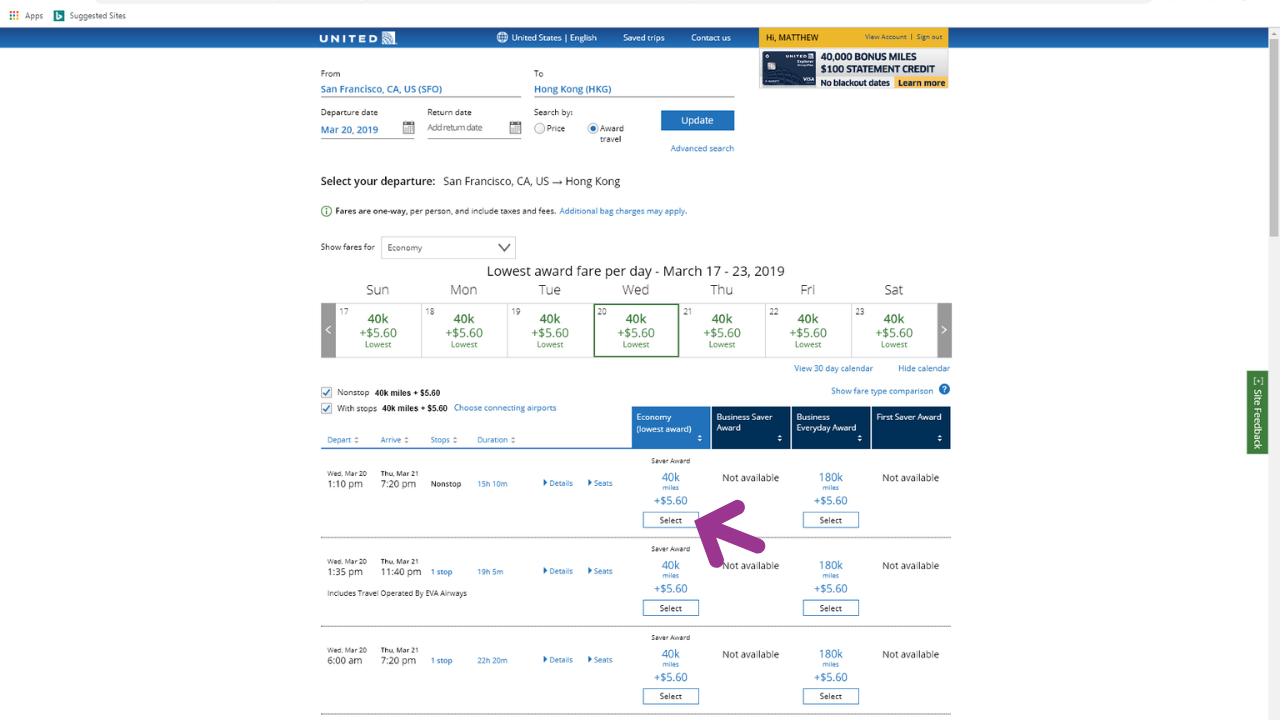

Two of my favorite transfer partners are United Airlines and Southwest Airlines. United has a really great and easy to use website for booking with points. In my opinion, they are one of the best options for international travel. Southwest points are great for domestic travel and are also easy to use. Their points are also great because you can easily cancel your flight and get your points back whenever you need to.

THE CHASE BANK 5/24 RULE

Given that Chase points are so valuable, there is one catch. Chase Bank has a fairly strict rule for approving applications for their credit cards. This rule is known unofficially as the “5/24 rule”. Chase will not approve an application for one of their credit cards if you have opened five or more credit cards (from any bank) within the previous two years. So, for example, if you want to get approved for one chase card, you need to make sure you have only opened four cards or less within the prior 24 month in order to be successful. There are a select few cards out there that are thought to not count towards this rule, but to me, it isn’t worth a denial.

Now this rule may not seem like a big deal for most, but for people, such as myself, that open many credit cards every year (I currently have 14 open), it can make things a bit difficult. Knowing this rule, I recommend that people who are serious about this hobby, and are just starting out, try to sign up for Chase cards first. Once you have five Chase cards, then start applying for cards from other banks that have more lenient application rules. If you don’t plan to open an abundance of credit cards each year, this isn’t as dire.

Although I am locked out of applying for new Chase cards at the moment, there are ways in which I am able to rack up Chase Ultimate Rewards points fairly quickly using the existing cards I have. The absolute best way is by using a combination of two Chase cards for all purposes: The Chase Sapphire Preferred and the Chase Freedom.

THE CHASE SAPPHIRE PREFERRED CREDIT CARD

The Chase Sapphire Preferred card, in my opinion, is the best all-around card out there. Every type of traveler should at least have this card in their wallet! It is good for people who don’t travel too often, as well as for those that find themselves addicted to travel (such as myself). Currently, you will receive 50,000 bonus points if you spend at least $4,000 within the first three months after opening the card. It gives you two points per dollar that you spend on travel purchases and dining, which is great. The card is also great for using while traveling since it doesn’t charge foreign transaction fees when you make purchases abroad. Lastly, one of my favorite perks is that if you use the card to pay for car rentals, you are provided with rental insurance. So, this allows me to never have to worry about purchasing any extra insurance from the rental company. The card doesn’t charge an annual fee for the first year, but it is $95 after that. So, you could technically just try this card out for around 11 months. If you don’t like it, cancel before the first yearly fee. However, this is one of few cards that carry a fee that I will keep forever. I gladly pay the fee for this card every year due to all the cheap travel it provides me with.

**Please note: It is also important to know that there is another card out there called the Chase Sapphire Reserve. This is also a great card that comes with many extra perks (Priority Pass membership for airport lounges, a yearly travel credit, Global entry/ TSA precheck fee reimbursement, etc..) that the Preferred version does not come with. However, this card comes with a hefty $450 annual fee that is not waived the first year. Although the value of the perks more than offset the cost of the annual fee, I would say that this card is for people who travel fairly often and who have a fairly high credit score. If you are an avid traveler and would like the extra perks, you could sign up for the Reserve version first (the card also comes with 50,000 bonus points). Then at any time before a future annual fee is due, you could call Chase and ask to be downgraded to the Preferred version. You won’t be able to get bonus points on the Preferred, but at least this way you can keep the benefit of using transferable points while only having to pay a yearly $95 fee instead of the $450 one. I will discuss the strategy below using the Preferred card since it is best for all types of travelers.

THE CHASE FREEDOM CREDIT CARD

There is a secondary card out there that, when used in conjunction with the Sapphire card, can really unleash the ability to accrue these valuable Chase points quickly and abundantly. The Chase Freedom Card (not to be confused with the Chase Freedom Unlimited card) is the perfect card to be used in addition to the Sapphire. This card has a bonus of $150 (or 15,000 cash back points) after spending only $500 within the first three months after account opening. It also has no annual fee, which means this card can be kept forever without closing and, therefore, help your credit score (by increasing your average age of credit factor). This card also has a good rotating spending category, which allows for a 5% cash back (or five points per dollar) accrual. The category changes four times throughout the year and lasts for three months at a time. For example, one quarter will be gas stations. So, for three months you can use the Freedom card to get five points for every dollar you spend at gas stations.

BENEFIT OF COMBINING THE TWO CARDS

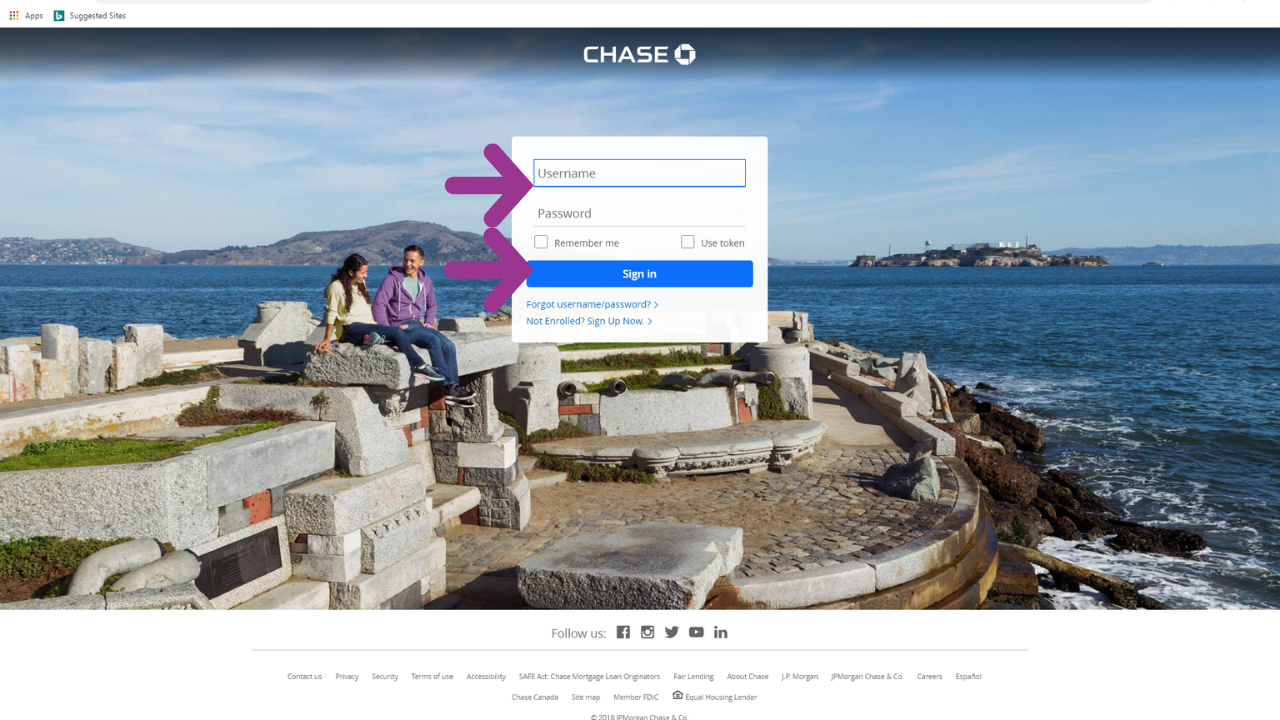

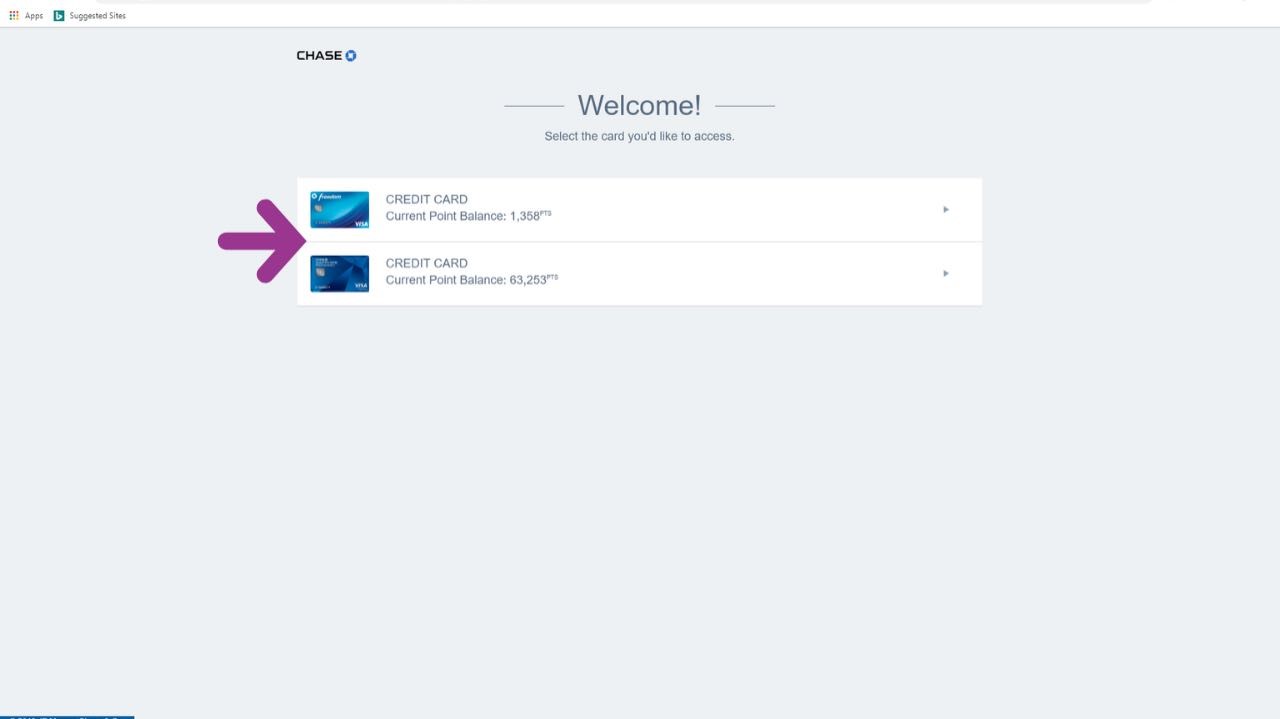

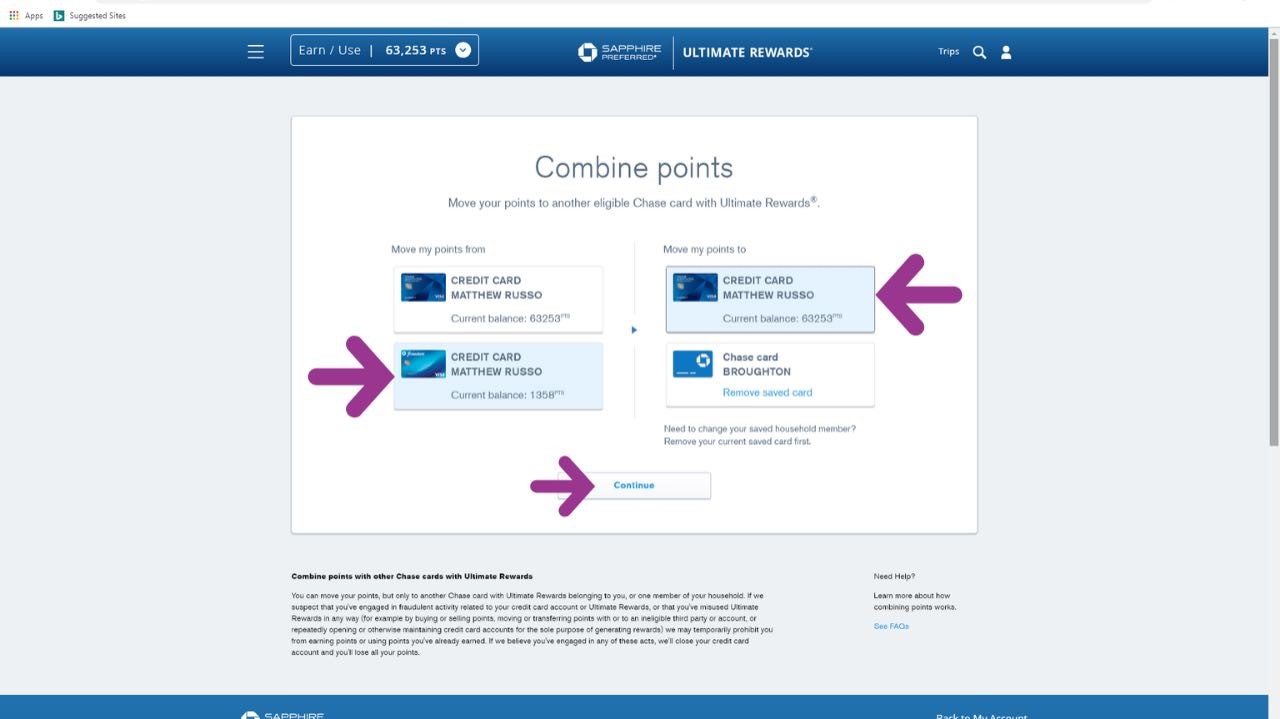

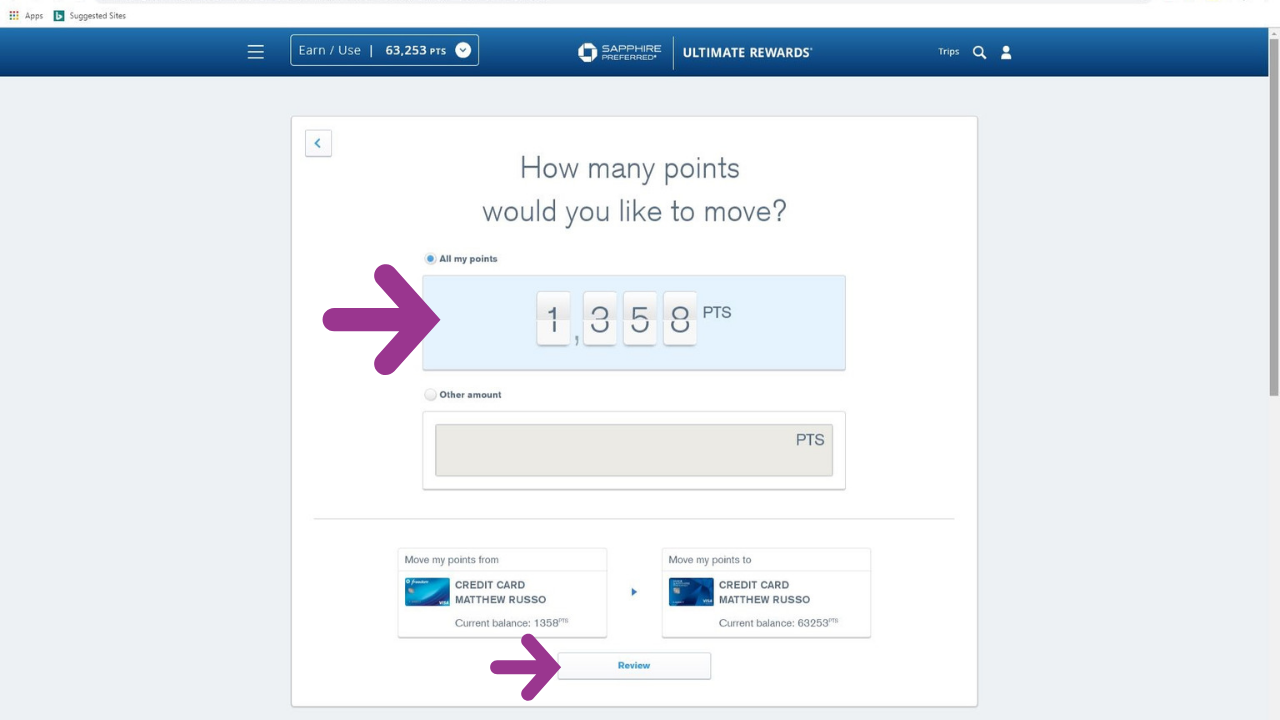

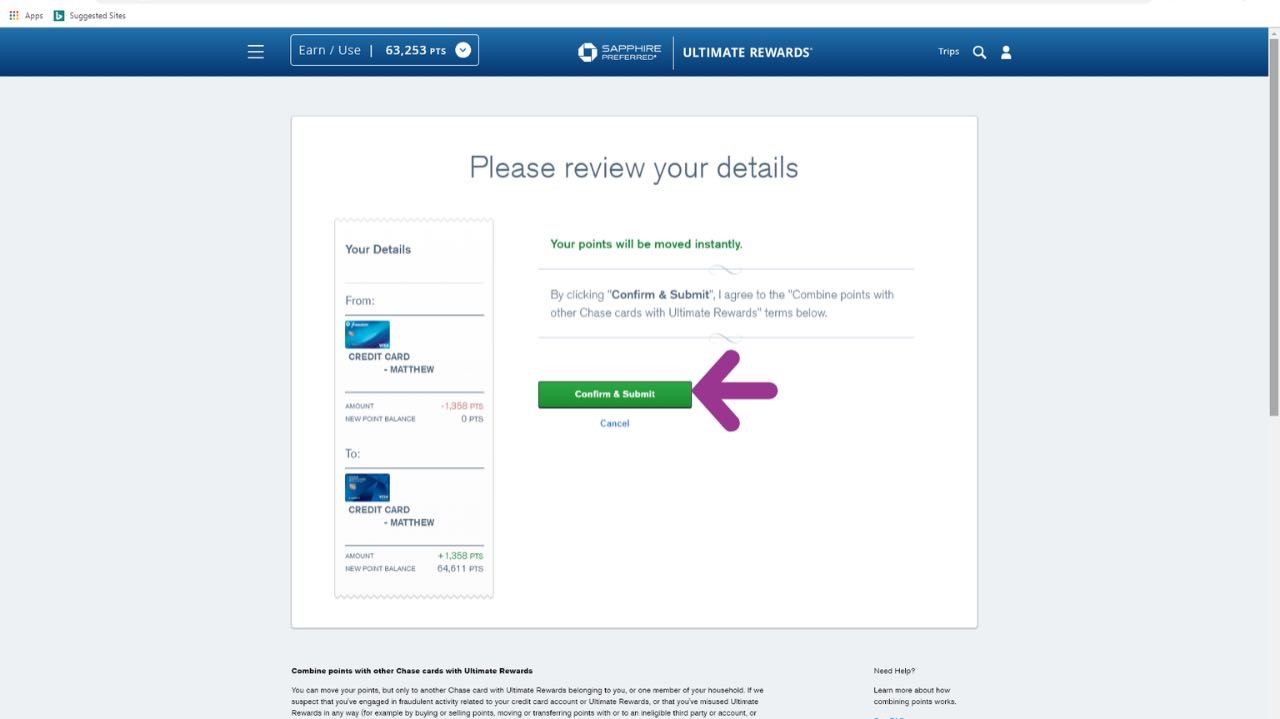

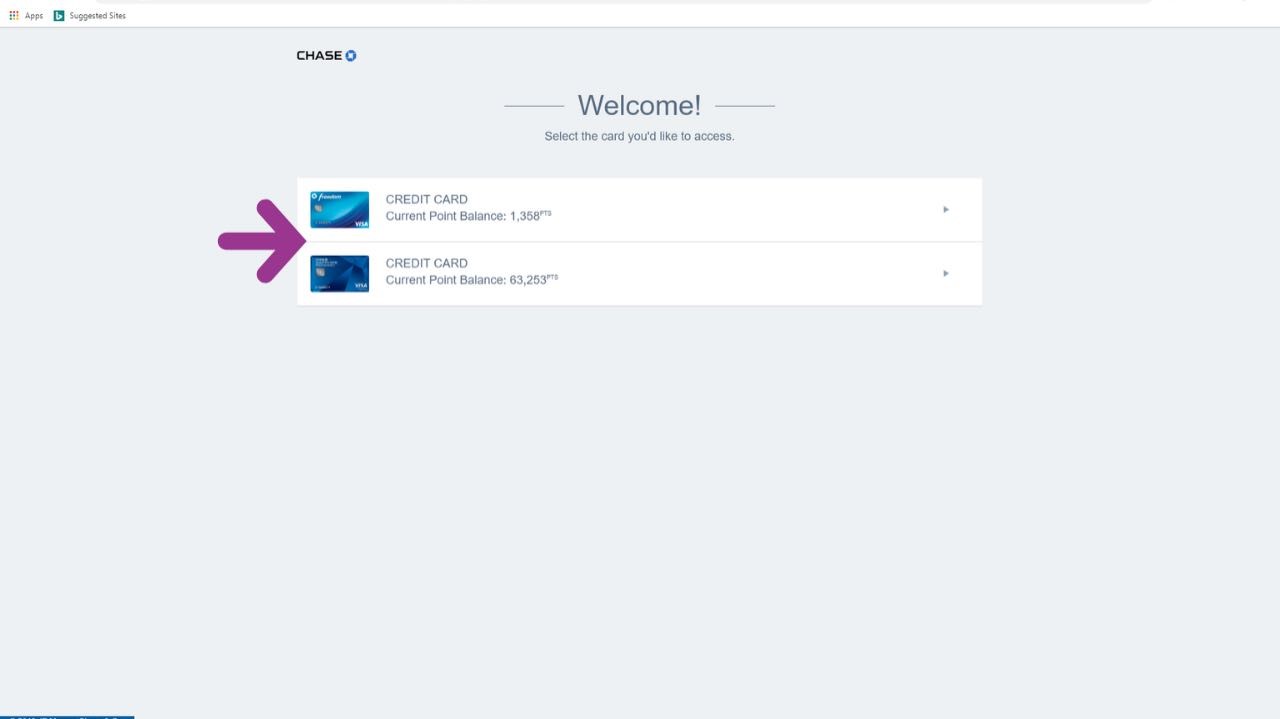

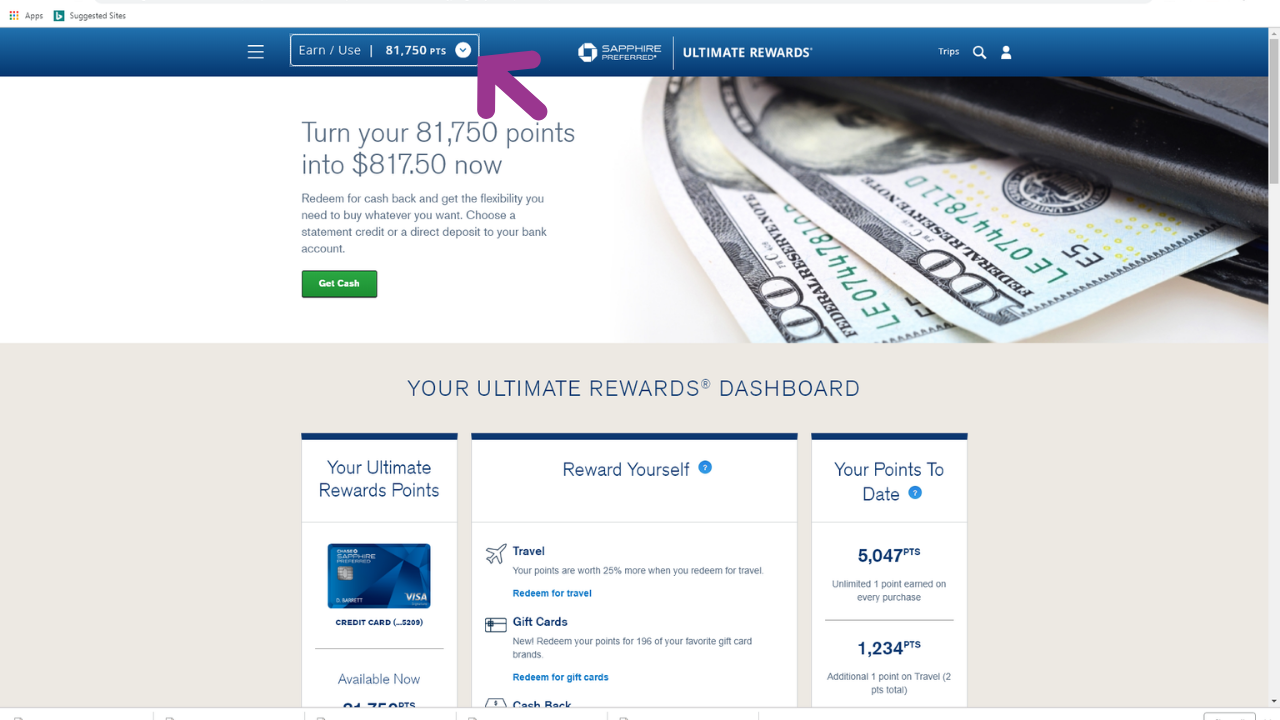

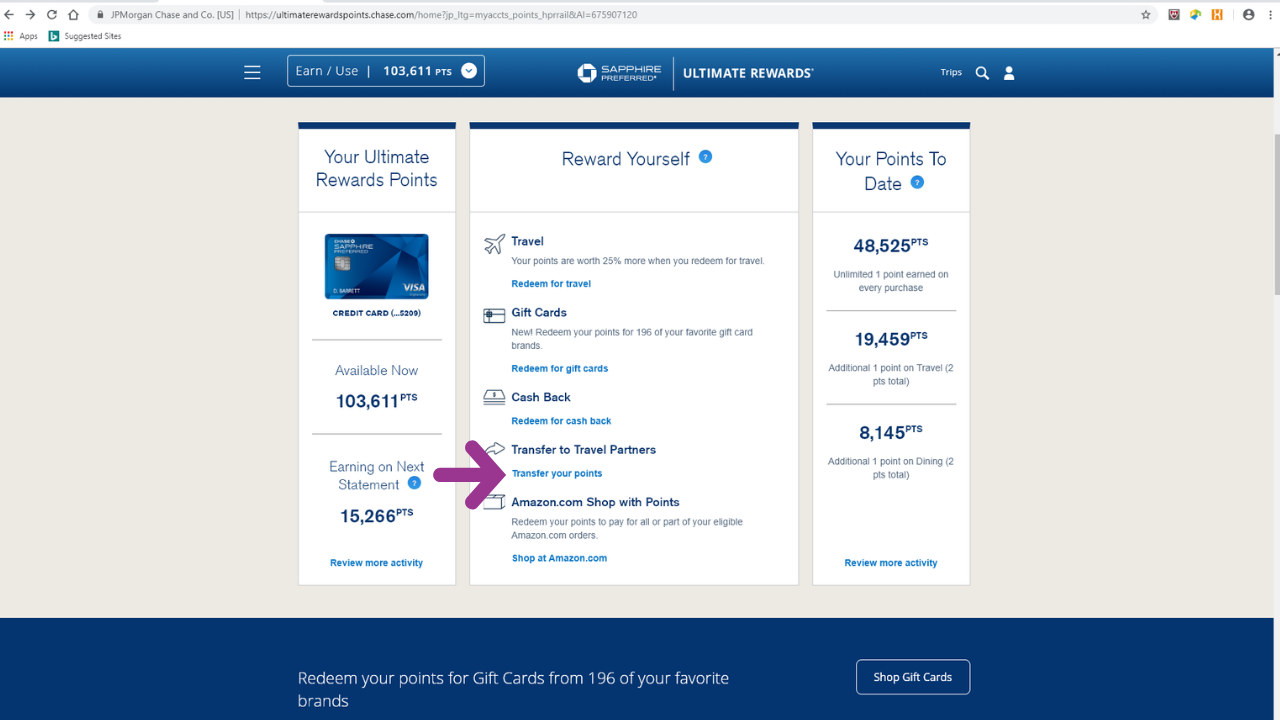

The Chase Freedom card is technically a cash back card, a card that earns points for getting money back, rather than points for direct airline and hotel redemption. When you have only the Freedom card, the bonus and any additional points you earn on that card can only be redeemed for cash back, or a credit towards purchases on your account. Cash back typically isn’t as good of a value in comparison to using points for travel redemptions. However, when the card is used correctly, it provides a strategic way to earn quite a bit of transferable points. If you hold both the Sapphire and the Freedom cards, you can link the two accounts so that you can move points back and forth. You can move any points from the Freedom to the Sapphire and you can use those points as Chase Ultimate rewards transferable points instead of cash back. For example, after you spend the $500 minimum spend requirement on the Freedom card, you will have at least 15,500 points on the card (bonus 15,000 points plus 500 points from the spending). Instead of using this for a $155 cash back credit, you would simply go online, or on the app, and click a few buttons to move the points from the Freedom to the Sapphire card. Now you can use these points as Chase Ultimate Rewards points and you can transfer them to multiple different airlines and hotel chains.

The strategy for the two cards is to get approved and obtain the sign-up bonus on both cards. After receiving the bonus on the Freedom card, move those points over to the Sapphire card. Then, from that point on, only use the Freedom card for the rotating 5% category and put every other purchase on the Sapphire card. For example, if the category is gas stations, only use the Freedom for gas purchases. For any other purchase you make, such as eating at restaurants or grocery shopping, use your Sapphire card. Every now and then, be sure to check your Freedom account. When you see that there are points there, move them over to the Sapphire card. By continually doing this, along with some additional strategies below, the transferable Chase Ultimate Rewards points will rack up very quickly. This is a very valuable way of accelerating the accrual of some of the most valuable points out there!

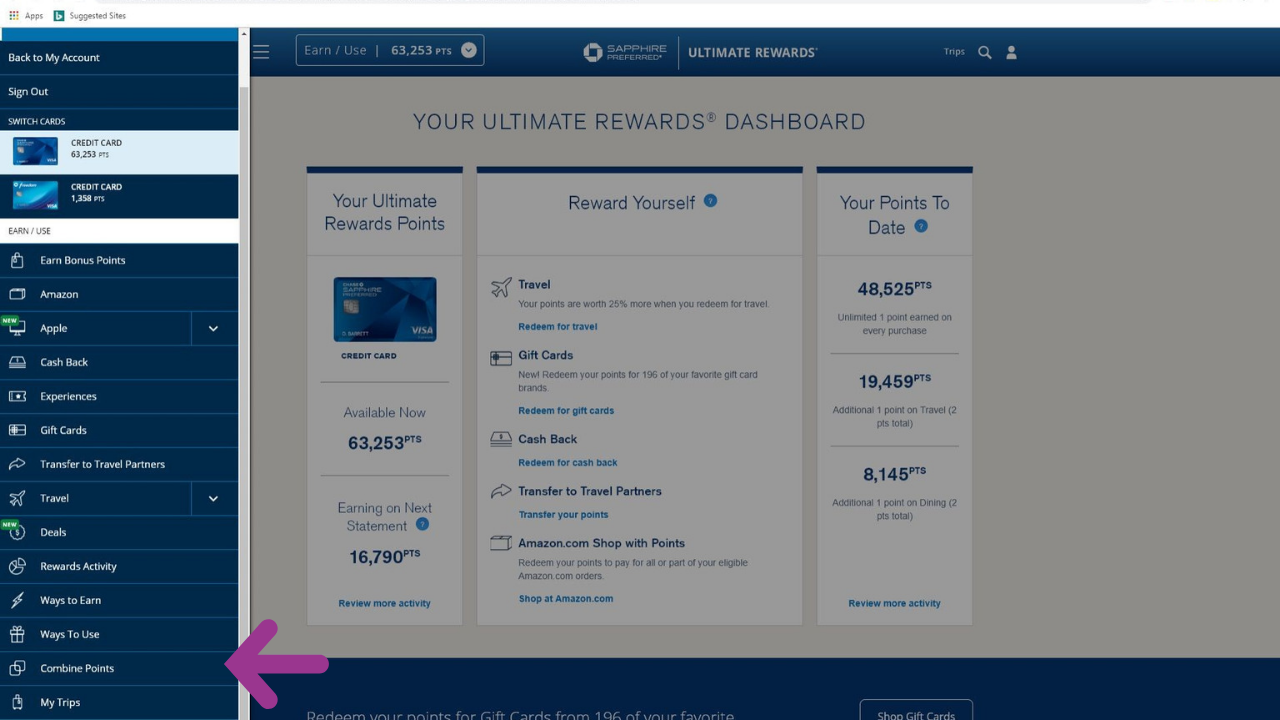

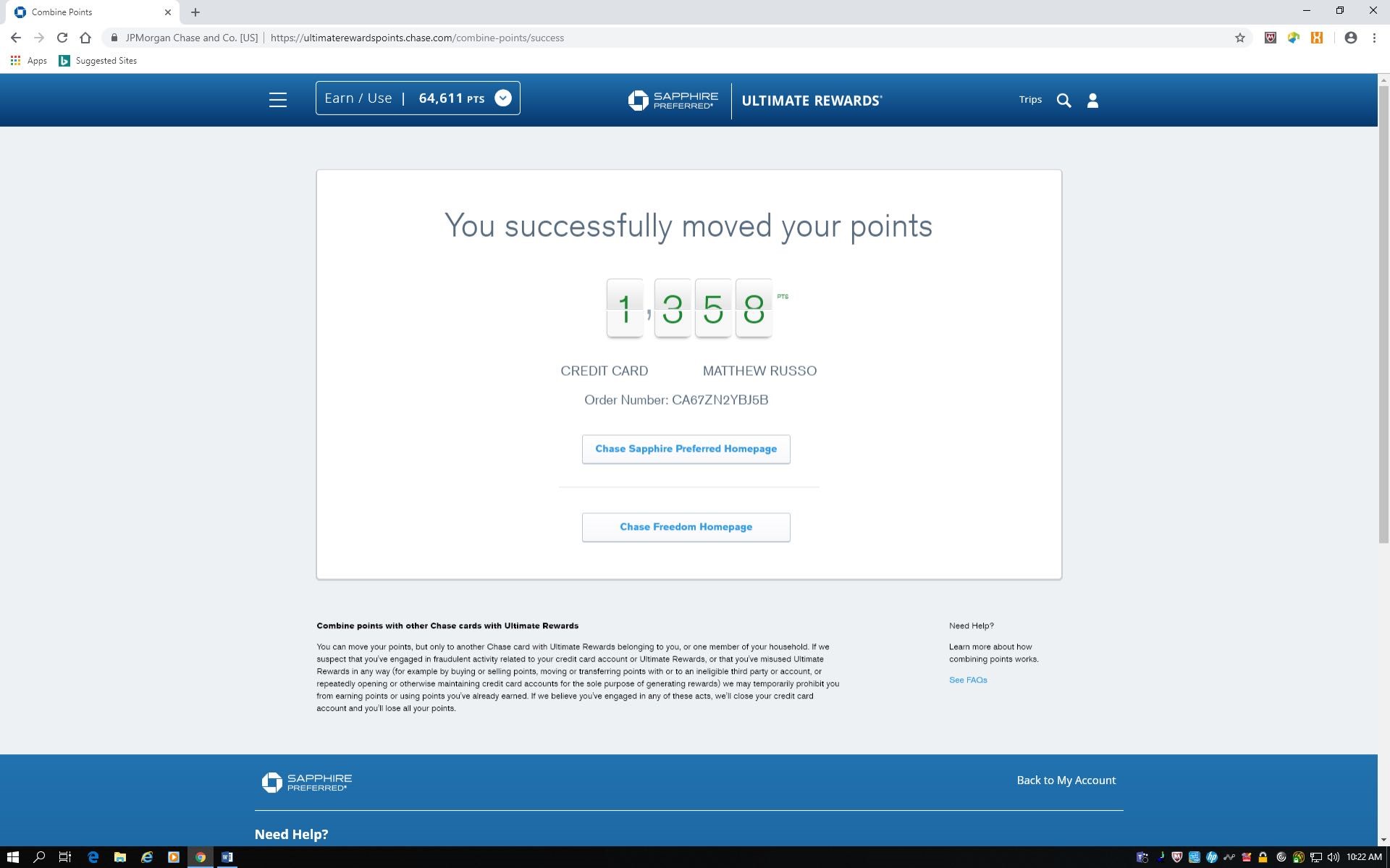

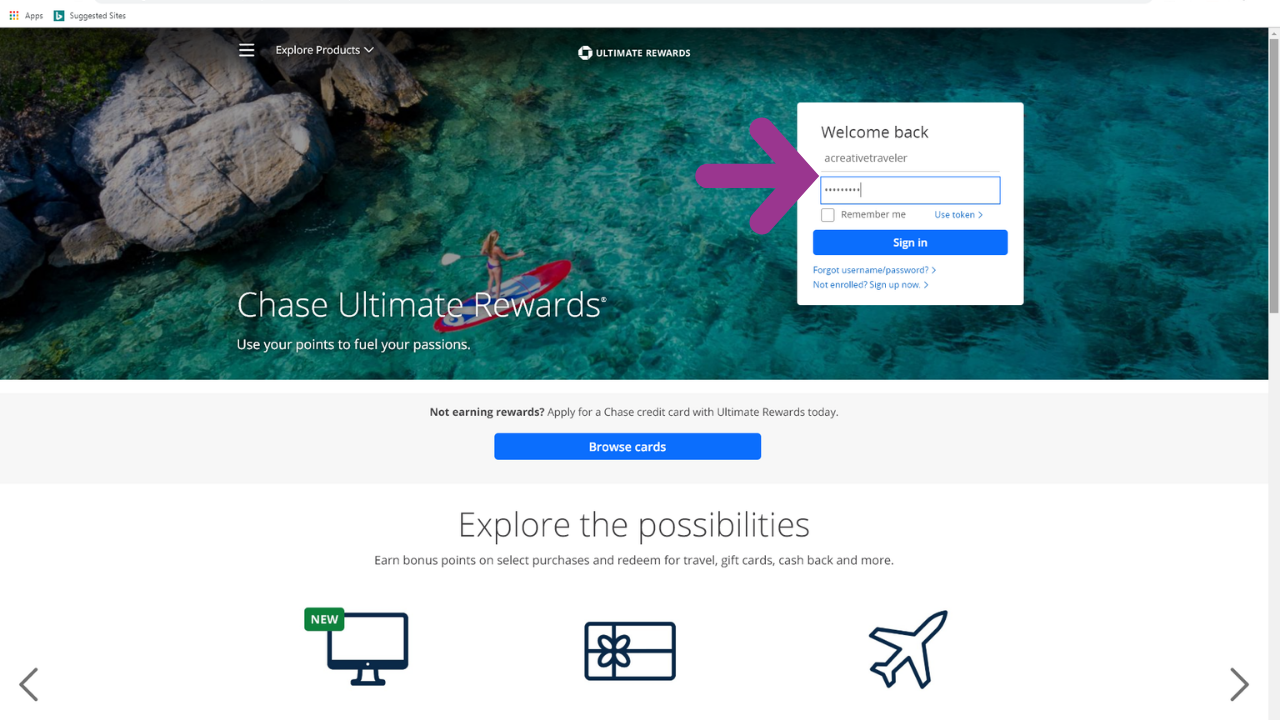

EXAMPLE OF TRANSFERRING POINTS BETWEEN THE TWO CARDS

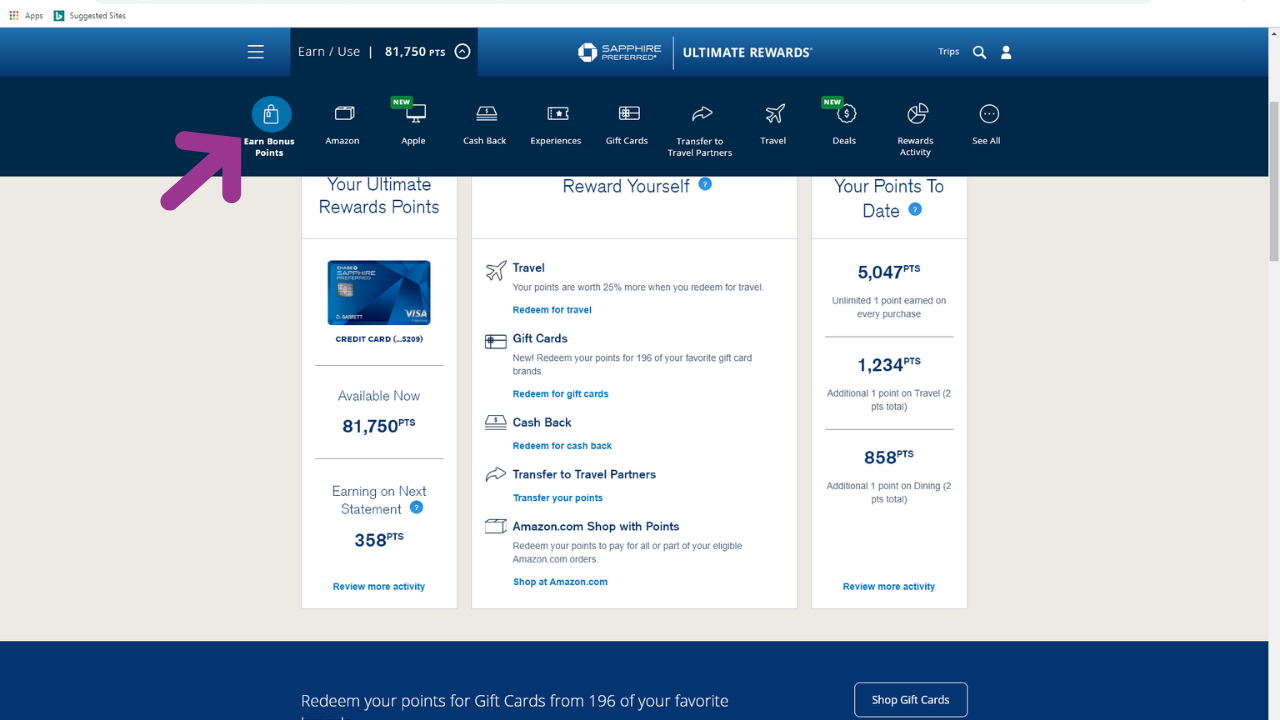

Below is an example of how you would move points from the Chase Freedom Card to the Chase Sapphire Preferred Card.

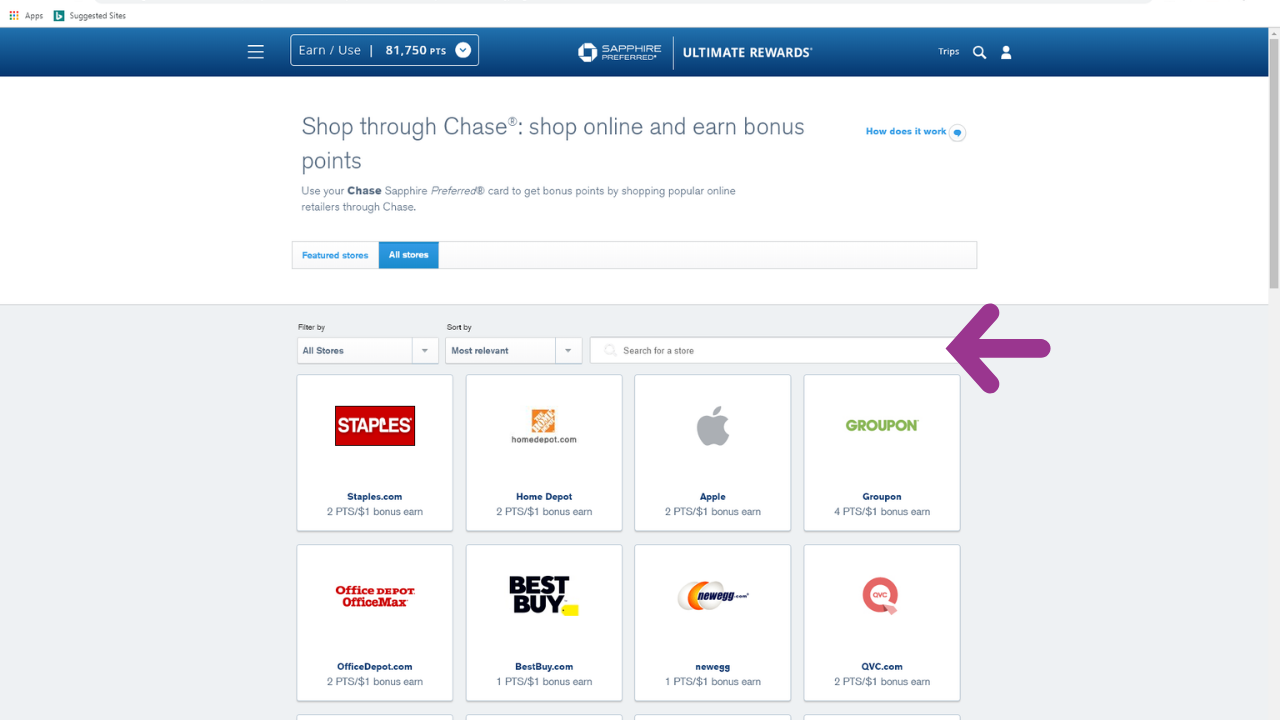

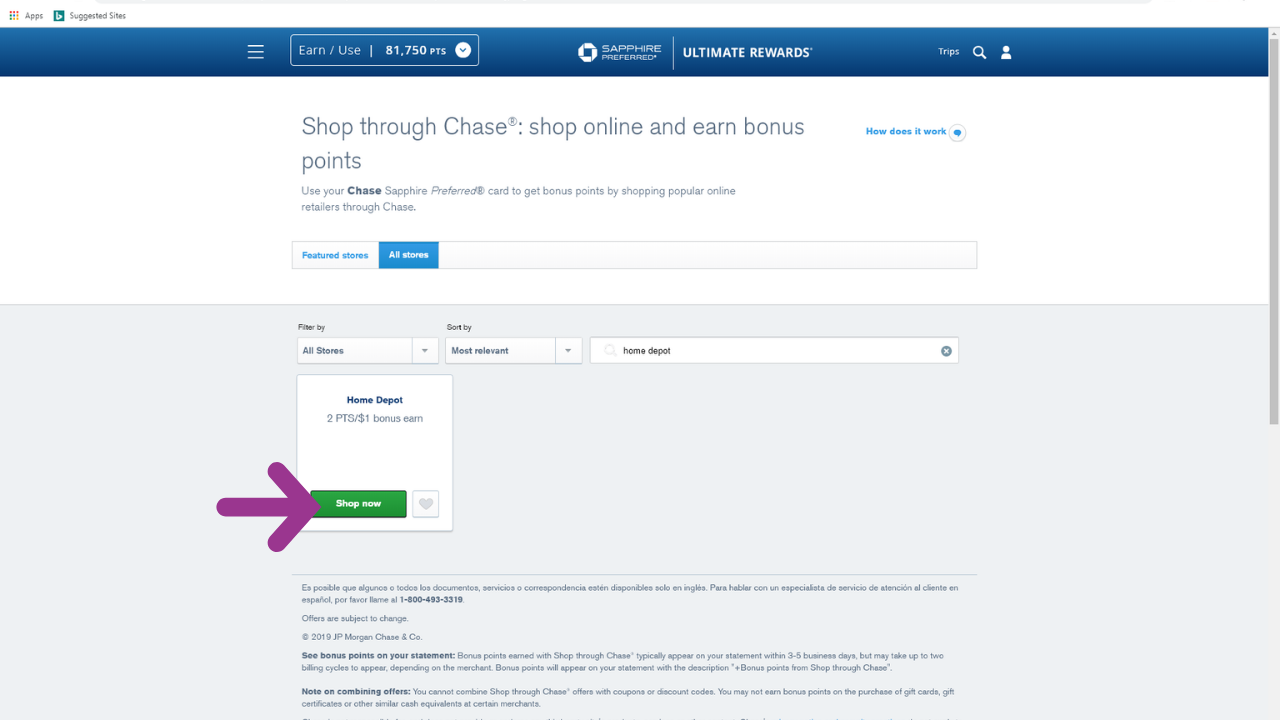

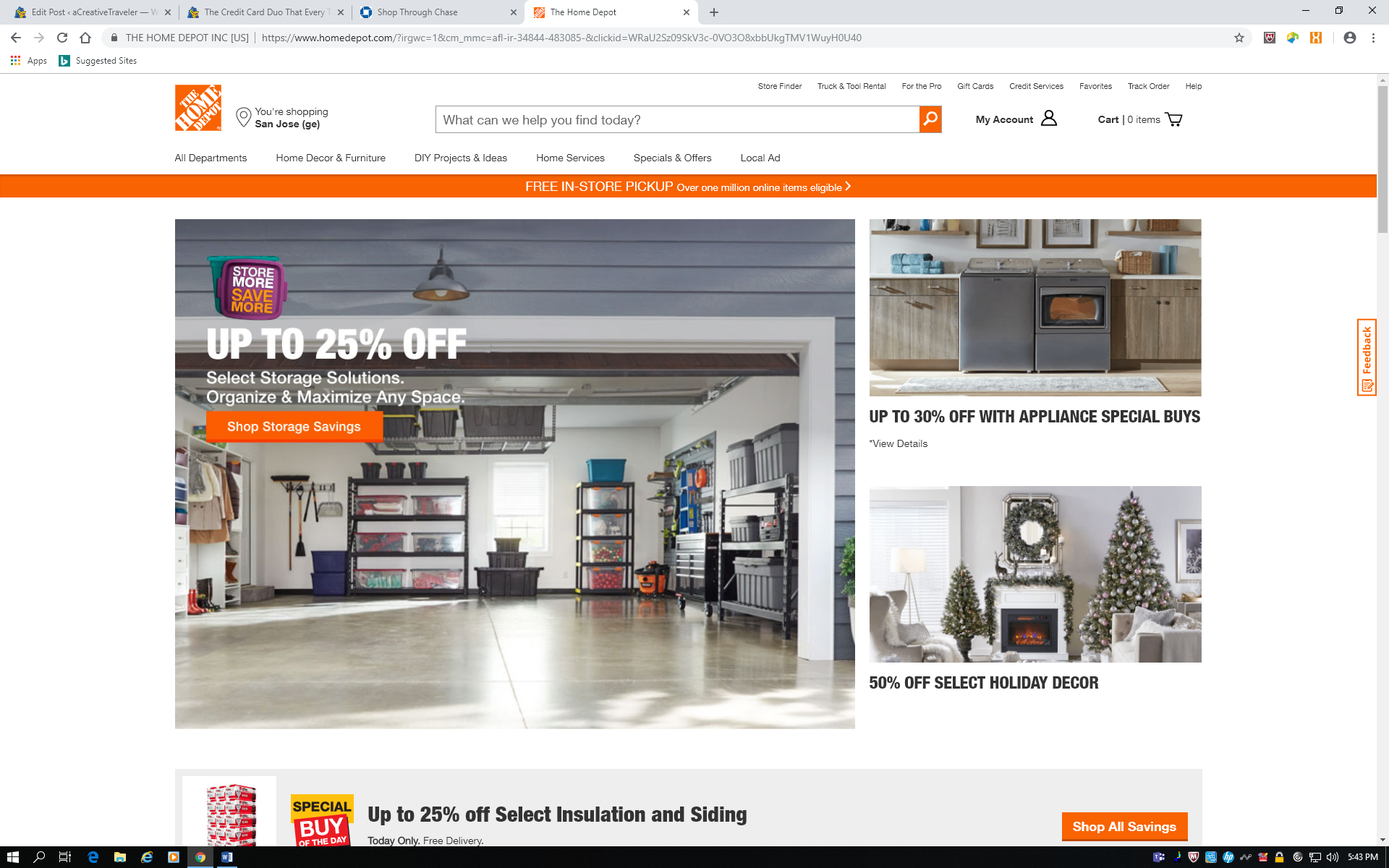

SHOPPING PORTALS

Many reward programs have their own shopping portal. Chase Ultimate Rewards is one of those programs. A shopping portal is just a website that links you to typical online stores. If you make purchases through that link, that reward program will give you a certain amount of points per dollar that you spend. The reason these are so valuable are because it gives you the ability to double dip on points for a given purchase. This is the case because the reward program that is linking you to the online store gives you a certain amount of points, but you are additionally getting points from the reward program for the credit card that you are using to make the actual purchase with as well.

For example, let’s say you want to purchase something from www.homedepot.com. You can log in to your Chase account, click the link for the shopping portal website, and search for The Home Depot. It will tell you how many points you will currently get for shopping there, such as 3 points per dollar spent, and provide you with a link to their website. When you click on the link, any purchase you make will be tracked and you will receive the allocated point rate. Additionally, you would want to use your Chase Sapphire card to complete that purchase. So, let’s say you spent $56 on homedepot.com through the link provided. This would give you 168 points (56 times 3 points per dollar spent) from using the shopping portal link. Then, you would also get 56 points from using the Sapphire card (56 times 1 point per dollar spent). This would give you a total of 224 points from this single transaction. Now you can imagine how lucrative this would be if you were making a large purchase on homedepot.com, such as when you are doing some home renovations or something. However, it is important to remember that even small purchases add up quicker than you would think. If you are worried about having to pay shipping and handling fees from online purchases, you typically have the option to pick up at the store. This is a great extra way to rack up a lot of these valuable points. Try to take advantage of Chase’s shopping portal whenever possible!

EXAMPLE OF USING THE CHASE SHOPPING PORTAL

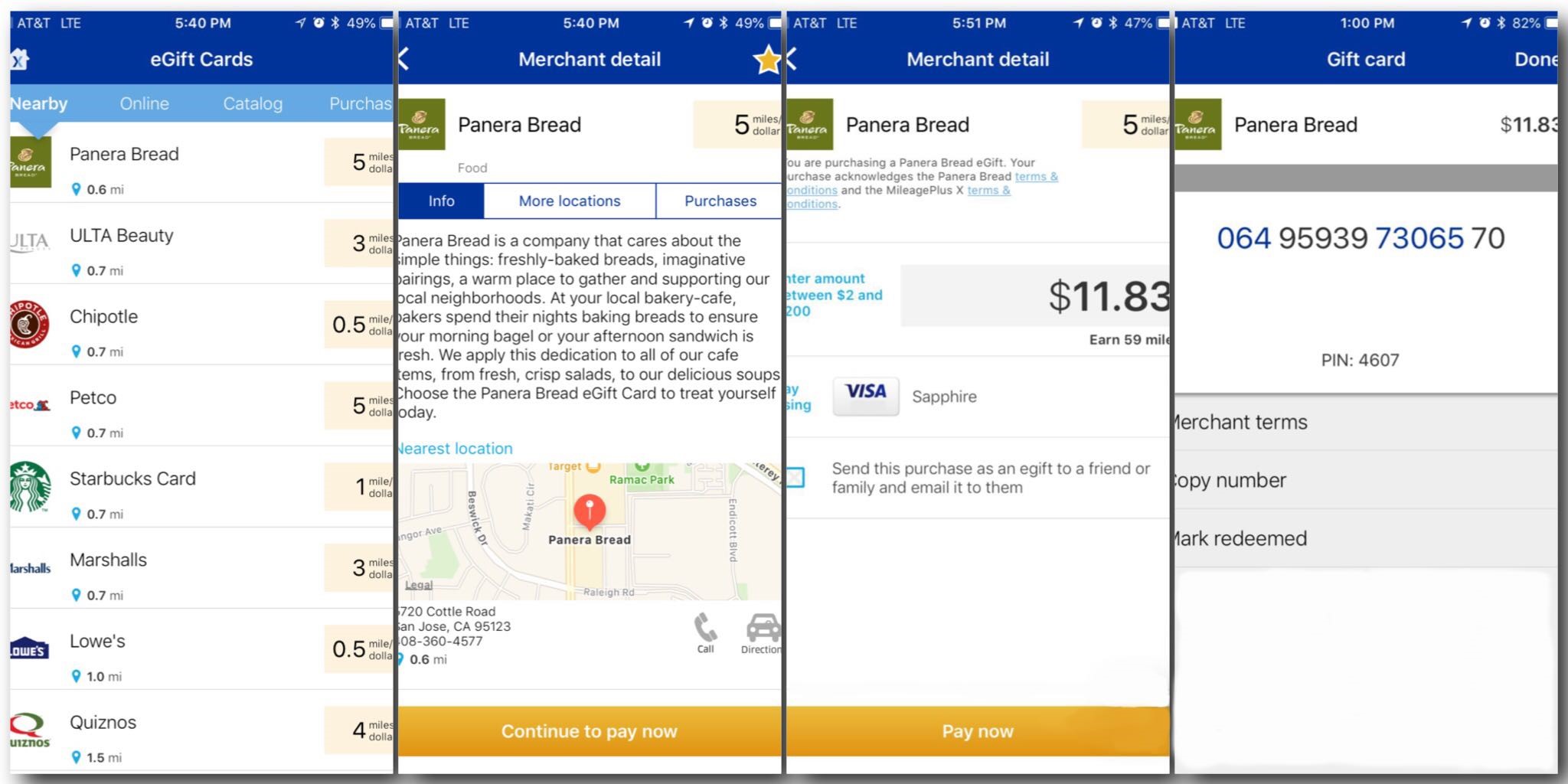

MILEAGE PLUS X APP

Another great way to gain some extra points that are relative to this strategy is by using something called the Mileage Plus X App. This is an application that I have downloaded on my phone that allows me to search different restaurants and merchants and create gift cards for them. By making purchases this way, I can get awarded points for United Airlines. If you remember from the information above, United is one of my favorite transfer partners for Chase points. The more points I can gain with United’s reward program, the less I will have to transfer from my Chase account in the future.

You first must create a Mileage Plus Rewards account with United, which is very easy to do on their website. You will use that info to login to the app and enter as many credit cards you want to the account. In keeping with the theme of this post, I would recommend using the Sapphire card for these purchases. As an example, let’s say I am going to eat at Panera Bread for lunch. I would search the app to see if that is a possible merchant. If so, it will tell you how many extra points they offer. So, let’s say they currently offer 5 points per dollar spent. The cashier at Panera bread would tell me the total amount for my purchase. I would then choose my sapphire card within the app and enter the appropriate amount. The app will then charge the credit card and create a gift card number and pin. You will give this info to the cashier and complete the purchase as a gift card transaction. So, if the total for the purchase was $11, I would get 55 United points (11 times 5 points per dollar) by using the app. I would also get 22 Chase points (11 times 2 points per dollar spent on dining) from using the Sapphire card in the app. This would give me a total of 77 points for this one transaction.

Now, it is very important to note that this method involves gift card purchases. Due to this, you must remember that there are no returns, only exchanges, from merchants. For example, if I use this app for a purchase at Lowes and I decide that I need to return an item later, I will only able to get store credit. Because the app utilizes a gift card, a return will be treated the same as a gift card transaction. With this in mind, I only use this app for purchases I know I will not need to return. The best use would obviously be for dining since there is a very low likelihood of a return. Also, it is a good route since the Sapphire card offers a good redemption rate of 2 points per dollar on dining.

REFERRAL BONUSES

The last way to aid in the rapid accumulation of Chase Ultimate rewards points is to take advantage of referral bonuses. Chase offers bonus points when you refer people to sign up for their credit cards. For example, Chase offers me 10,000 points for every approved application from someone I refer (with a yearly max of 50,000). I can simply go on their website, or their app, and send a quick link to people I know. If they sign up through the generated link provided, I will receive the bonus points. After realizing how great these cards are for gaining travel, this is a wonderful way to help your friends and family and, in the process, you will also be rewarded yourself with more travel opportunities. By using the links in this post, you can help me get referral bonuses in order to earn more points and more experiences to share with the world! If you would rather not, simply head over to chase.com to find separate application links (or click here).

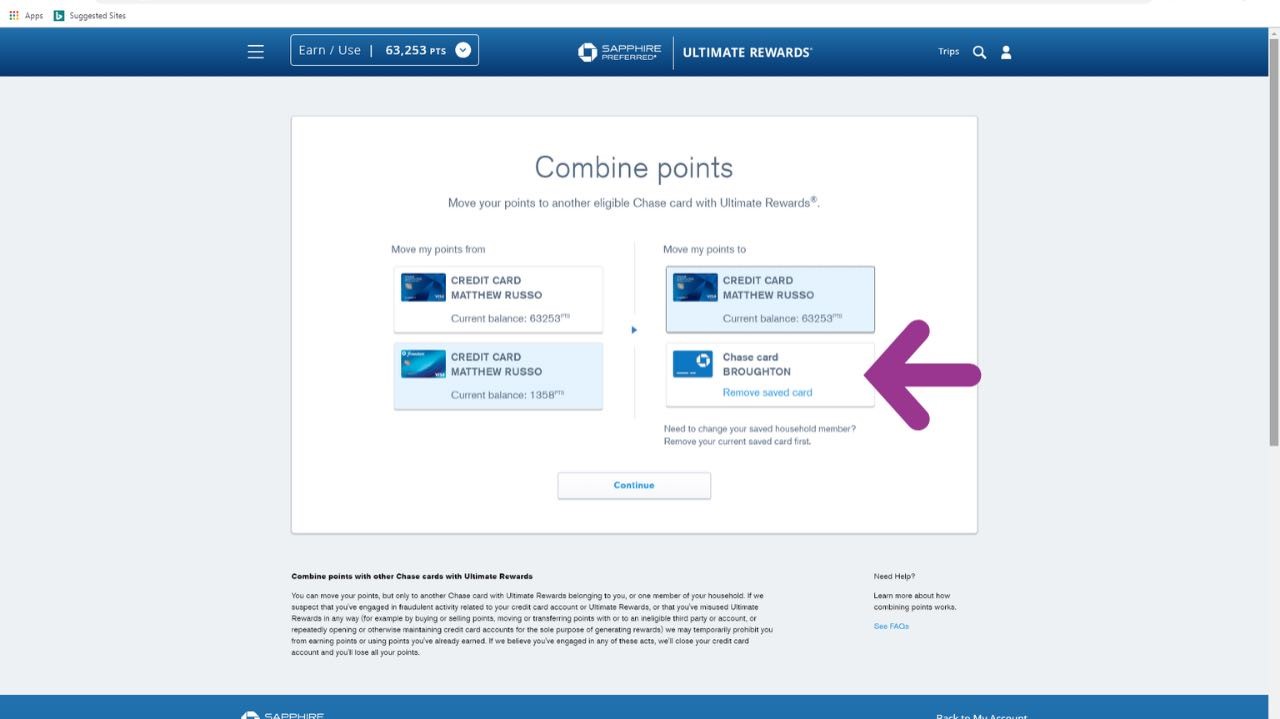

COMBINING POINTS WITH SPOUSE

Another thing to keep in mind is that Chase allows you to pool points with a spouse or domestic partner living at the same address. This is extremely useful! This really makes award booking easier and more efficient. By taking advantage of this tool, my wife and I were able to strategically combine points for our epic honeymoon trip around the world. It would have been extremely difficult without this ability. To do so, you would simply go online to the same place you would to move points between the two cards. There will be a place to enter your spouse’s rewards account and personal info. After you do that, you will be able to easily move points between cards, as well as, between you and your spouse all in one place.

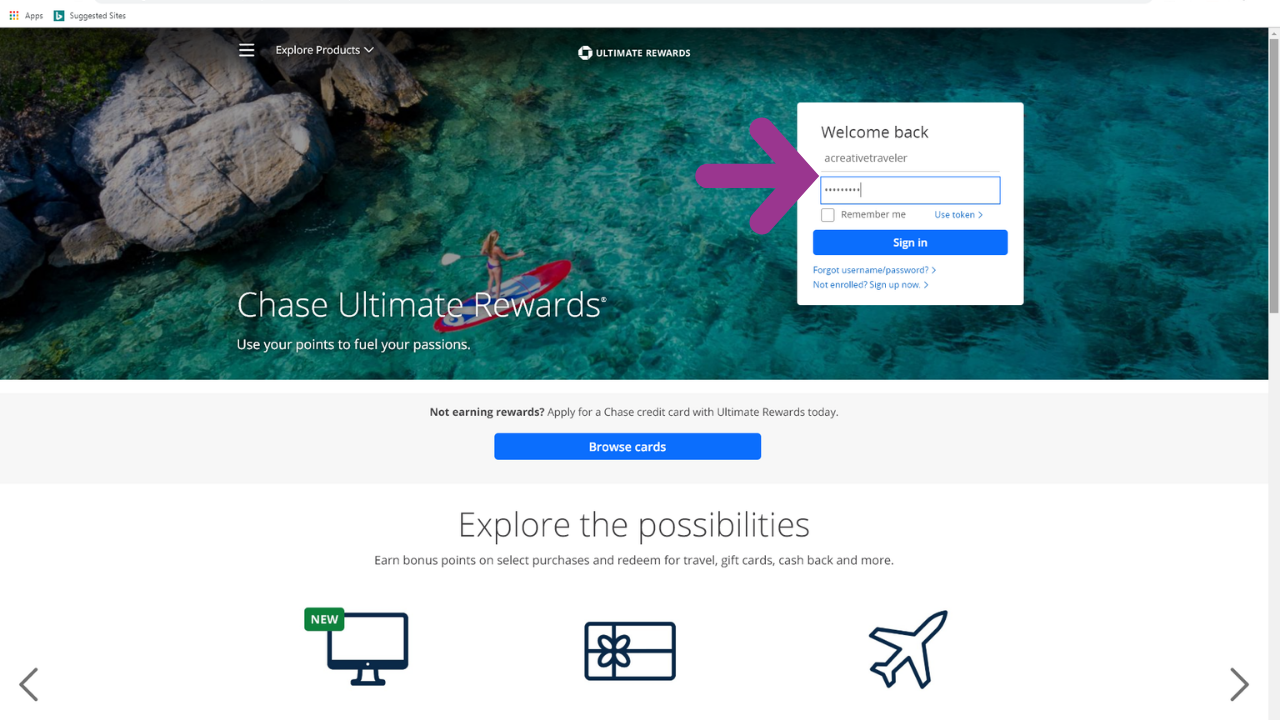

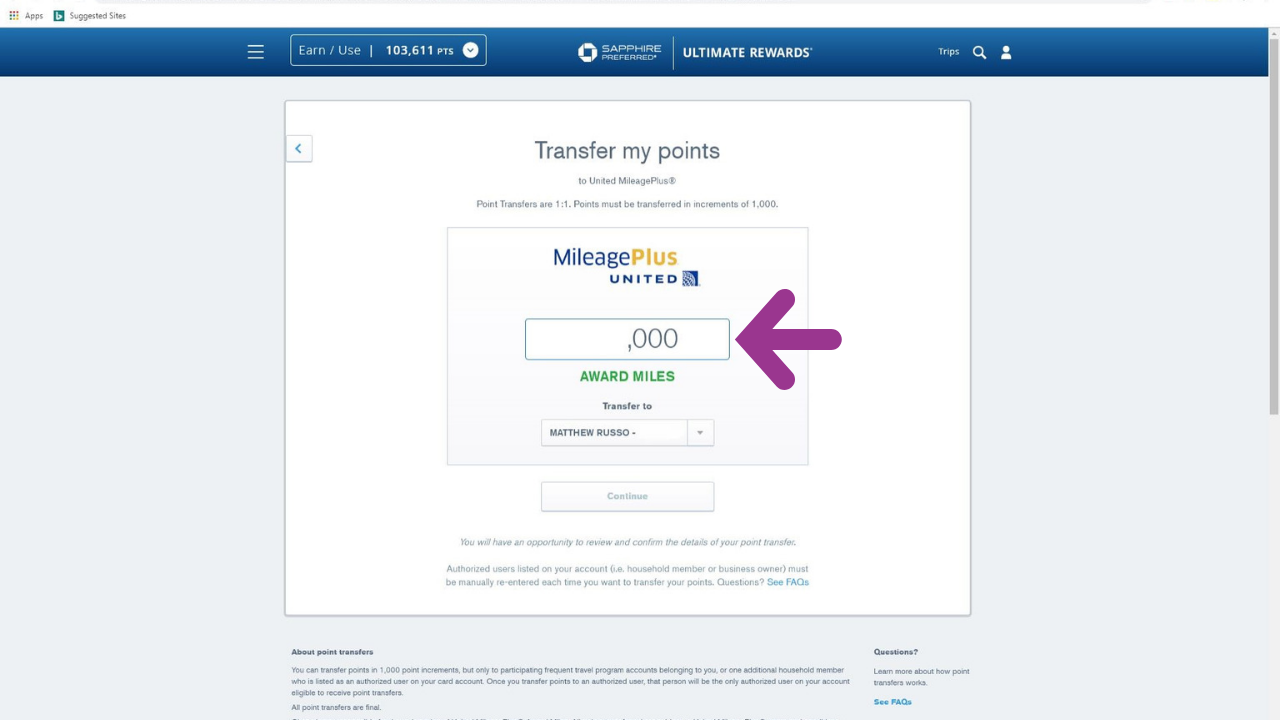

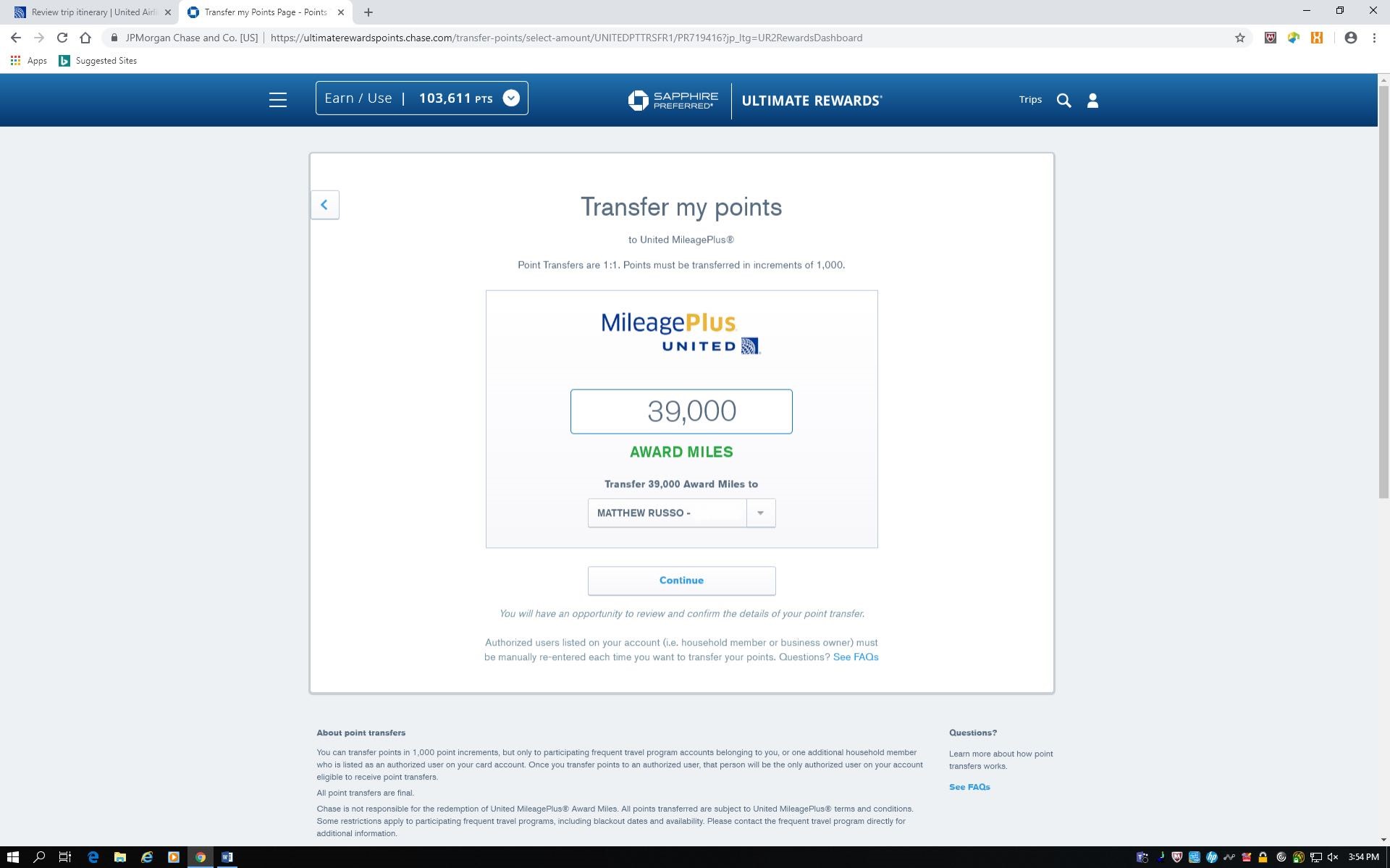

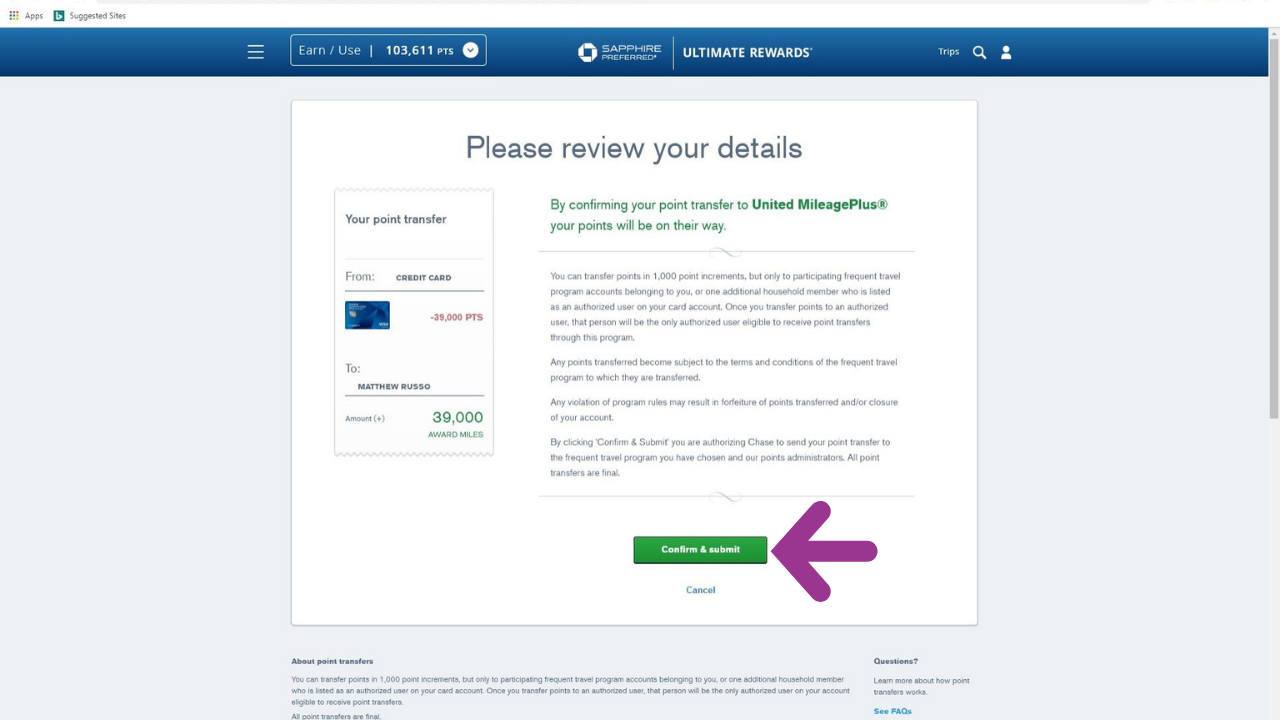

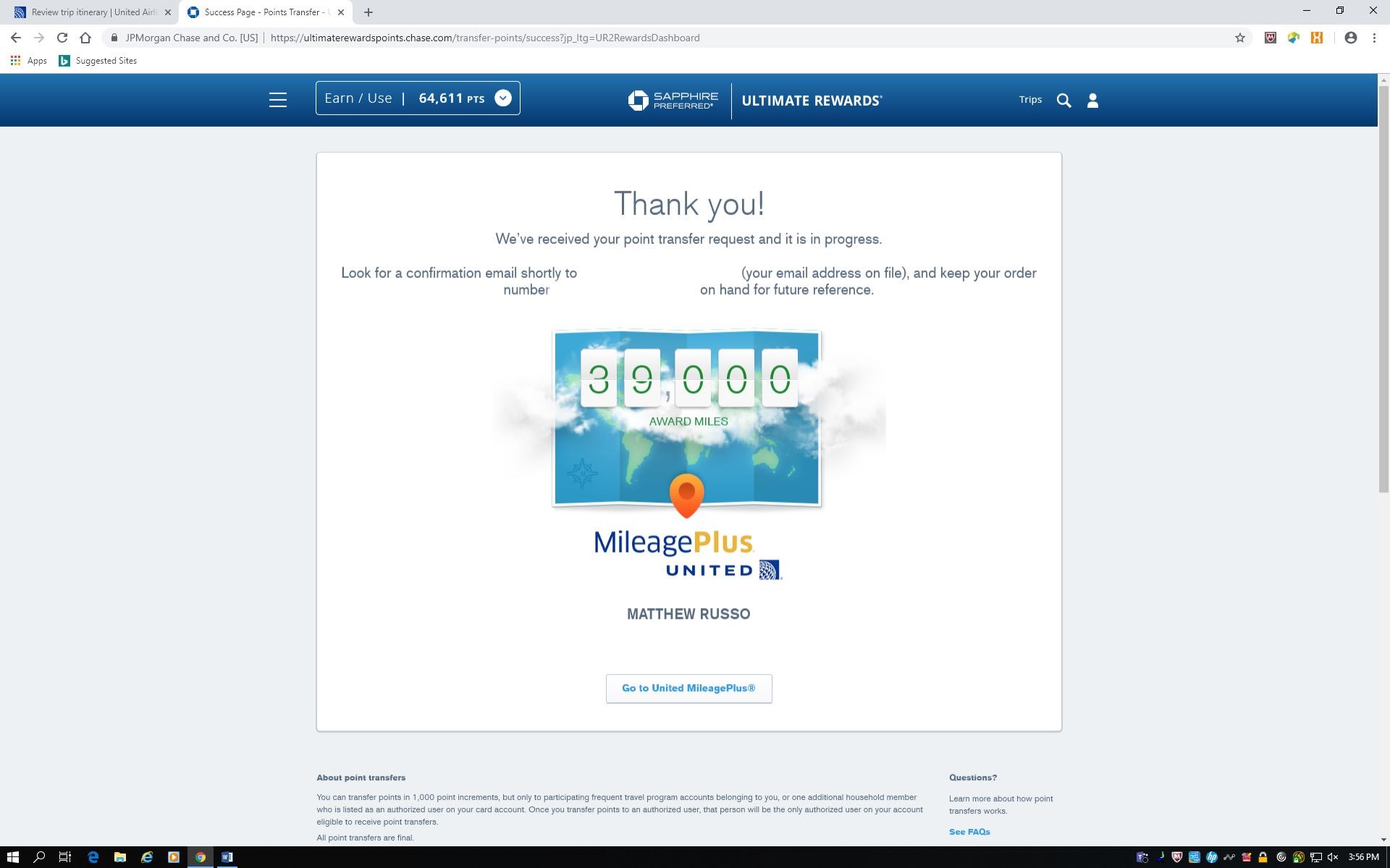

EXAMPLE OF TRANSFERRING CHASE POINTS TO AN AIRLINE PARTNER

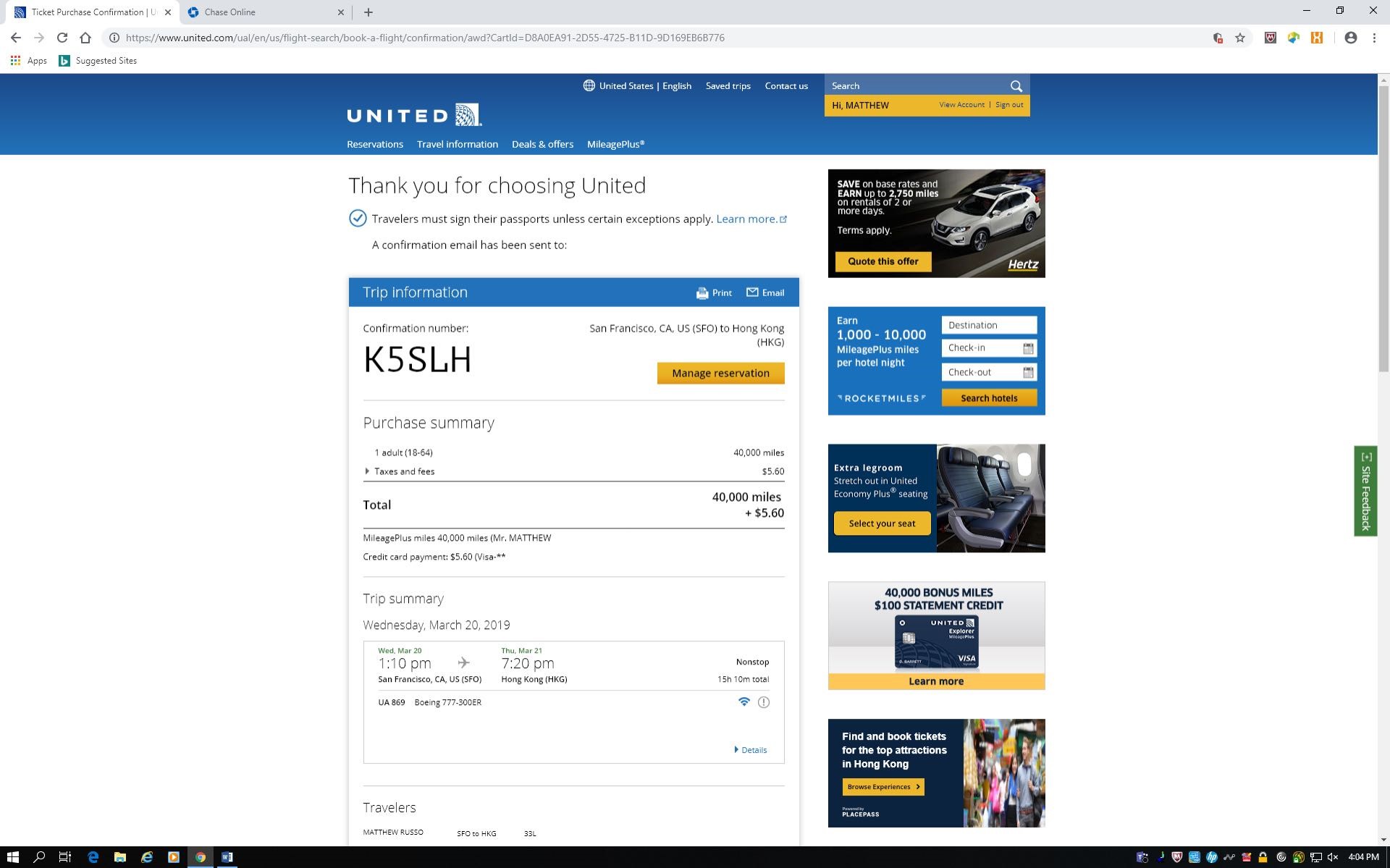

Below are snap shots of the process of transferring points to a Chase partner airline to book a flight. In this example, I transferred my Chase points to United airlines so that I could book a trip to Hong Kong in March.

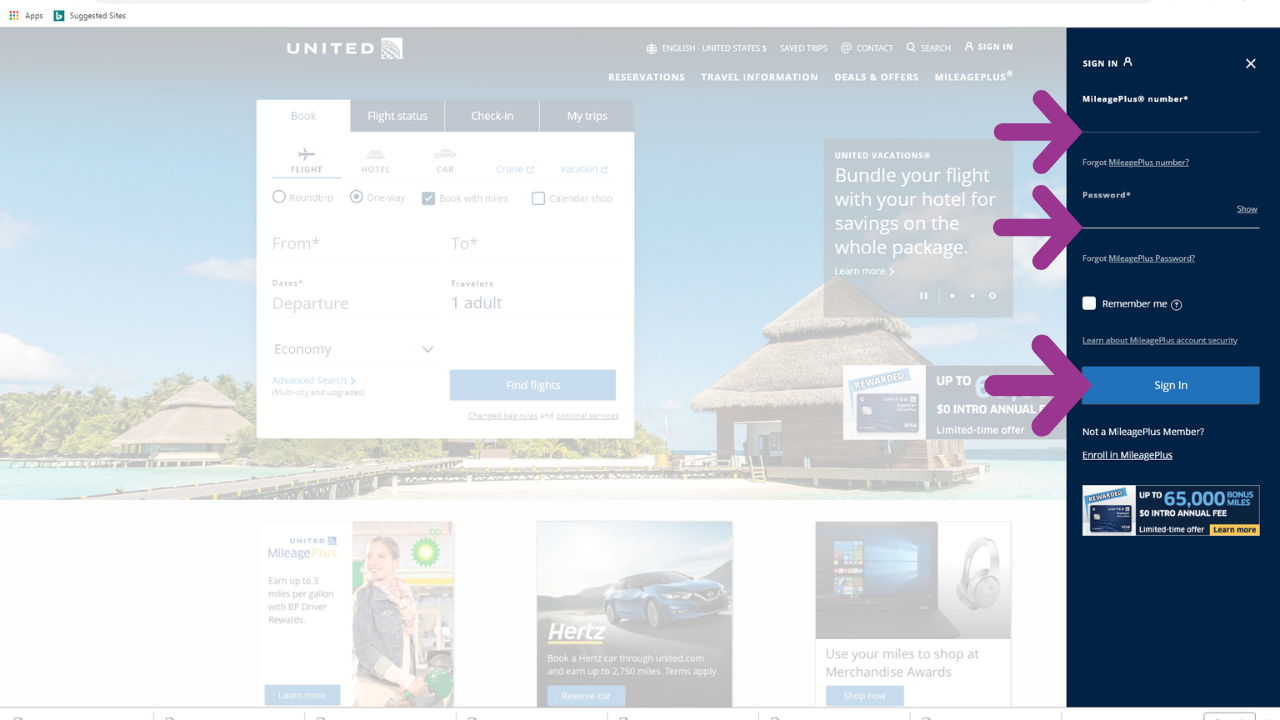

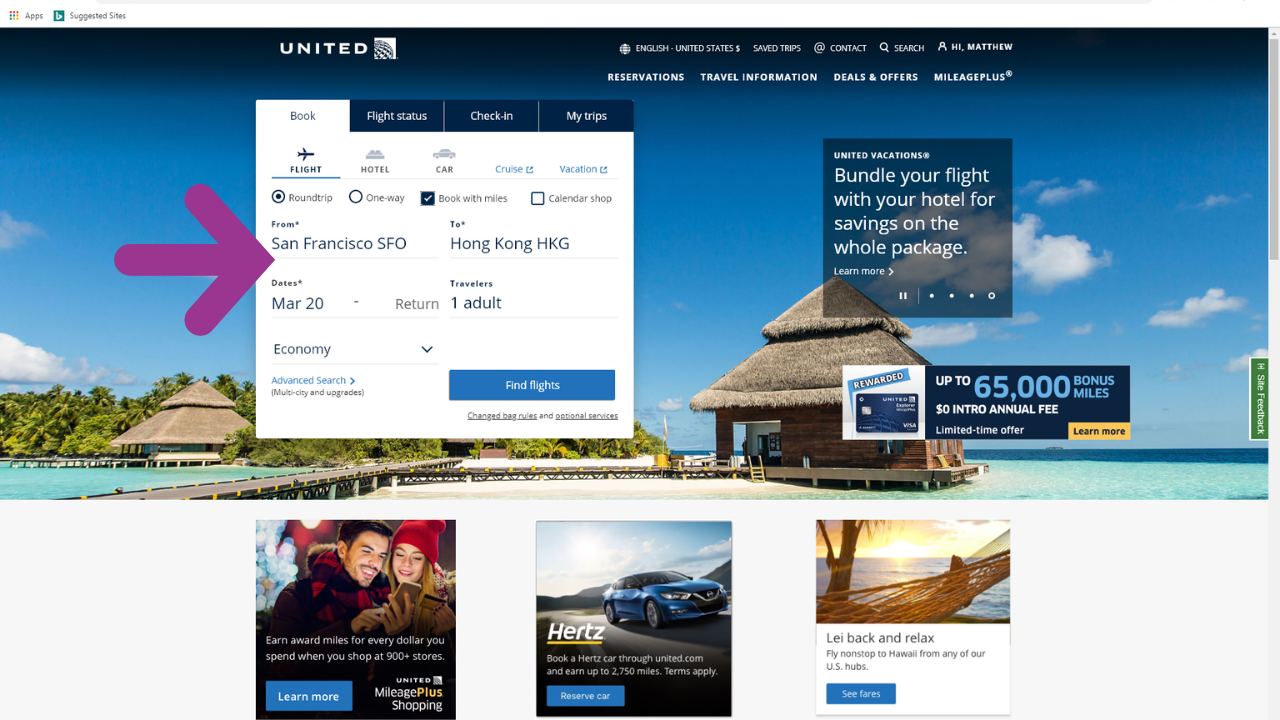

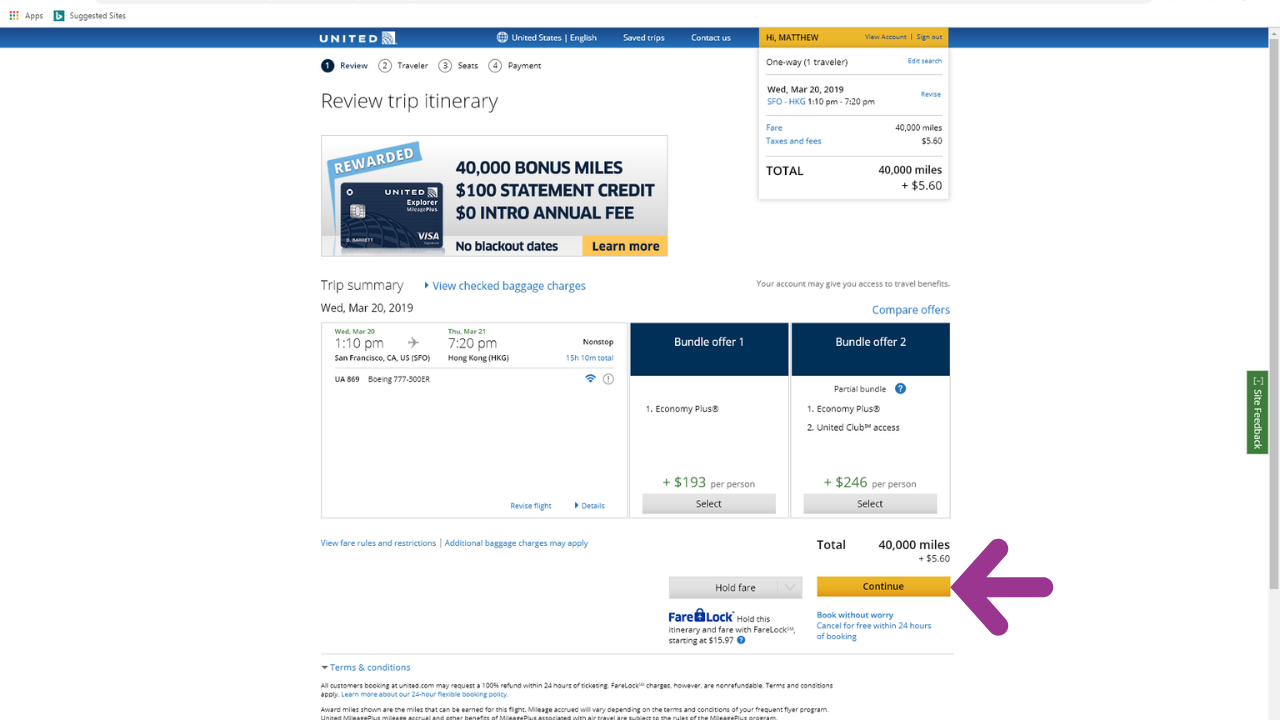

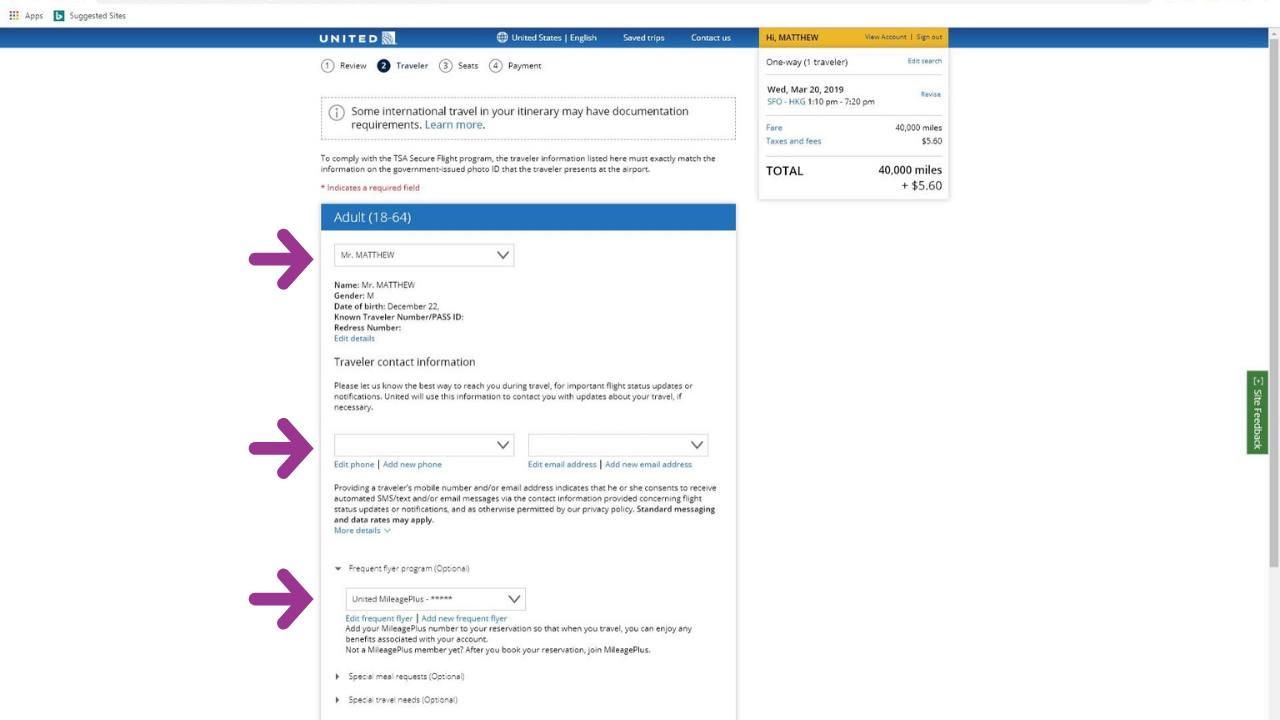

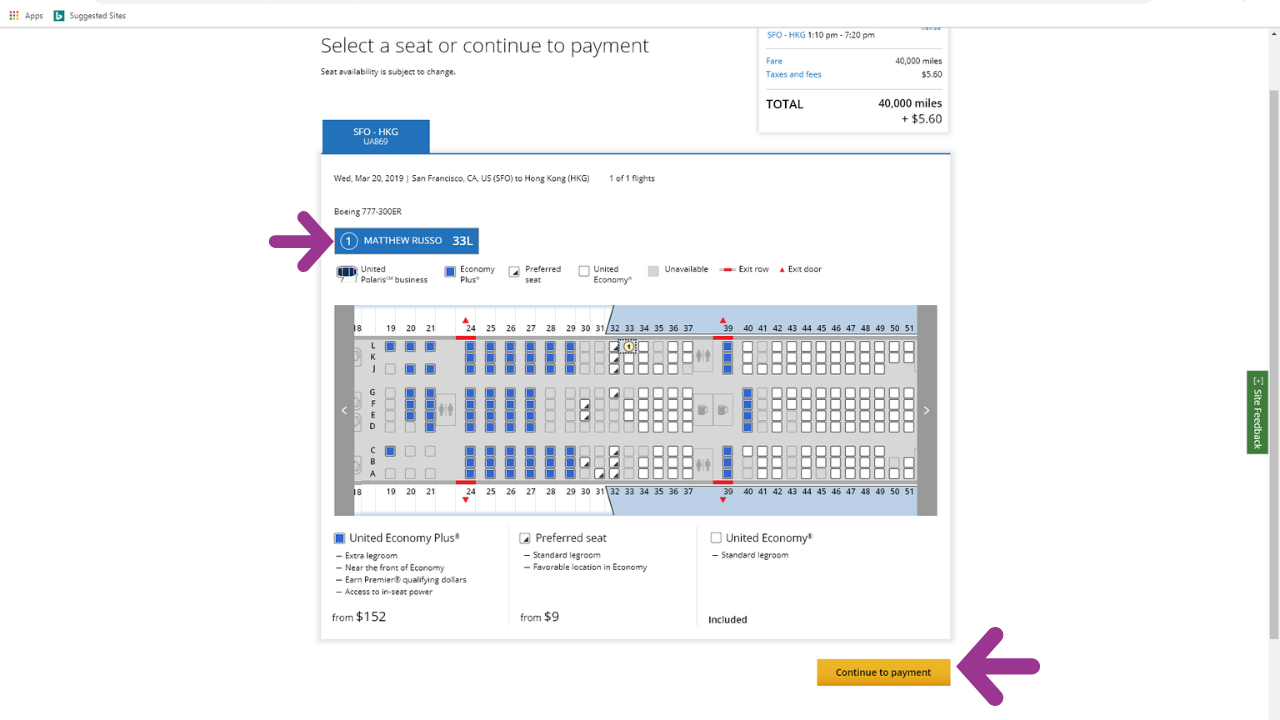

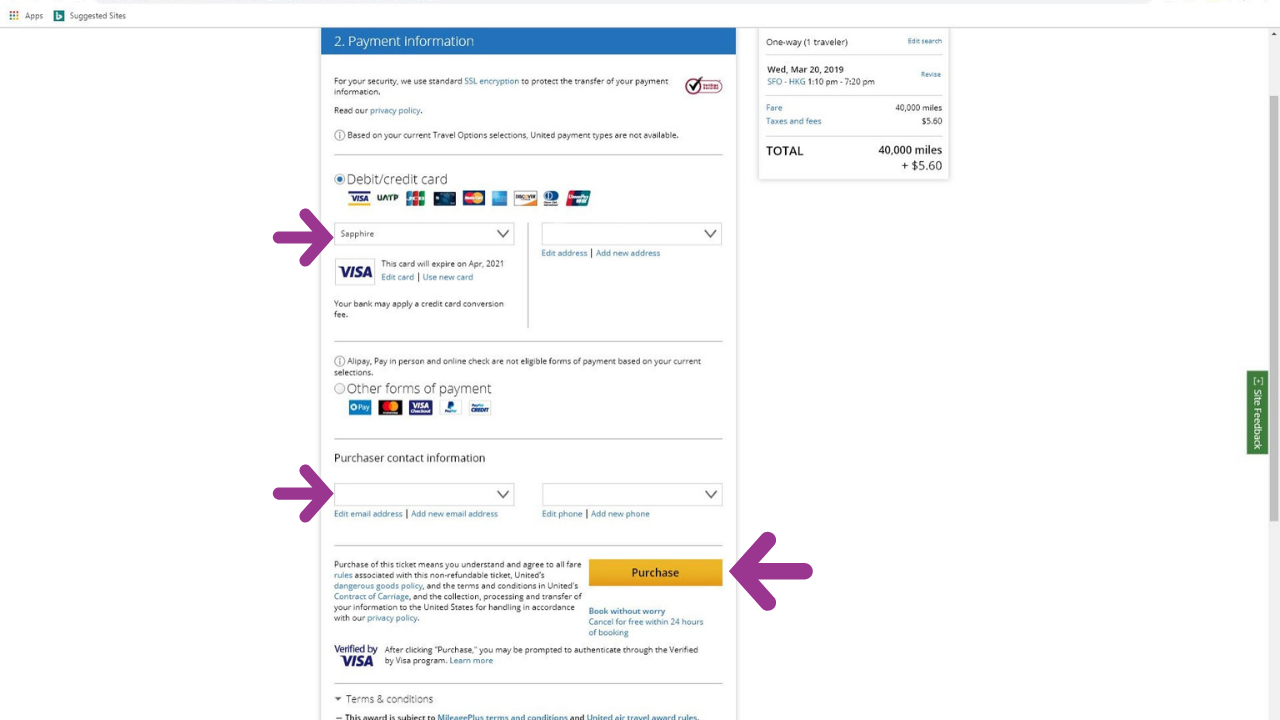

EXAMPLE OF BOOKING A FLIGHT AFTER TRANSFERRING TO A PARTNER

After the transfer is completed, I can now head over to the partner airline website to search for, and book, a desired flight. Below is an example of these steps.

BOOKING TRAVEL DIRECTLY THROUGH CHASE’S WEBSITE

It is also very important to know that you don’t always have to transfer points to partners to book with points. You can also book flights and hotels directly through the Chase Ultimate Rewards website. This can actually be a much easier means of booking awards. However, doing this typically isn’t as good of a value as when you transfer to partners. Most of the time you will pay a bit more in points and you will also pay more in taxes and fees. In my opinion, it is almost always better to transfer to partners before booking, but there are some instances where booking through Chase can be useful. For example, some cities may not have any hotels from the available transfer partners chains (Hyatt, IHG, Marriott, Ritz Carlton). Or sometimes the point rate for one of those are just too high. In these cases, it may make sense to go this route. For most cities, the Chase website typically offers many hotel options at many different point levels, which allows you to be much more strategic when booking.

EASY TO USE MOBILE APP

One of my favorite things about these two cards is the app from the bank that issues them. Chase does an excellent job with their phone app and they make it very easy to manage your accounts. Since I bank with Chase also, it makes it easy for me to see all of my accounts in one place. Also, you can set up auto pay so that you don’t ever have to worry about being late on a payment. Remember, that is the most important part of your credit score! You can also quickly and easily add travel notifications and send referral links for cards. Lastly, Chase allows you to lock and unlock cards at any time. So, if you don’t plan on using a card for a while, you can always lock it for added security.

RECAP/ PLAN OF ACTION

- Make sure you haven’t signed up for more than three credit cards within the last 24 months. You can check your credit report if you are having a tough time remembering. You want to make sure you haven’t signed up for more than three since you will be applying for two more cards. Remember, you can’t have 5 or more card approvals within a 24-month period with Chase.

- Check your credit score. You can use a free app such as Mint to do this. Using this app is safe, free, and doesn’t hurt your credit score. You want to have a score of at least around 600-650 to get approved for Chase Sapphire Preffered (around 700-750 for Sapphire Reserve).

- Apply for the Chase Sapphire Preferred card here (or the Reserve card if you would rather those perks and are ok with the hefty annual fee). Be sure to accurately enter your info on the application including your income and whether you currently have a checking and savings account. If you get a pending application, call the Chase reconsideration line at 1-888-270-2127 and ask if they need any additional info to process the application.

- Be sure to set up AutoPay online to ensure you do not ever miss a payment.

- Use the Sapphire card for ALL purchases until you reach the $4,000 minimum spend requirement. This includes everyday purchases as well as eligible bills. You have 3 months to do this. If you are having a tough time reaching the minimum, consider making large purchases for friends and family and have them reimburse you. You can also pay for group dinners with your card and just have friends Venmo you or give cash to reimburse you. Lastly, consider buying gift cards for places you frequently shop such as a grocery stores or gas stations.

- Before you make any purchase, try to evaluate whether or not the purchase can be made through either the Chase shopping portal online or through the Mileage Plus X app. Remember, this will allow you to double dip on points for each transaction done this way.

**TIP: If you don’t want to open multiple cards for some reason, you can stop here. I think everyone should, at the very least, have the Sapphire Preferred card in their possession. However, the accrual of points will be much faster with the secondary card. Also, don’t forget that having multiple cards doesn’t necessarily hurt your credit! In many instances, it can actually improve it! Read more about that logic here.

- Apply for the Chase Freedom card. Make sure you don’t sign up for the Chase Freedom Unlimited card by mistake. Be sure to accurately enter your info on the application including your income and whether you currently have a checking and savings account. If you get a pending application, call the Chase reconsideration line at 1-888-270-2127 and ask if they need any additional info to process the application. In some instances, they may need to simply move around some credit from other Chase card(s) in order to approve the new one.

- Once again, be sure to set up AutoPay online to ensure you do not miss a payment.

- Use the Freedom card for ALL purchases until you reach the $500 minimum spend requirement. This includes everyday purchases as well as eligible bills. You have 3 months to do this. Once again, if you are having a tough time reaching the minimum, consider making large purchases for friends and family and have them reimburse you. You can also pay for group dinners with your card and just have friends Venmo you or give cash to reimburse you. Lastly, consider buying gift cards for places you frequently shop such as a grocery stores or gas stations.

- Before you make any purchase, try to evaluate whether or not the purchase can be made through either the Chase shopping portal online or through the Mileage Plus X app. Remember, this will allow you to double dip on points for each transaction done this way.

**TIP: If you think you can spend enough, you can apply for both cards at one time. This is what I did. If you have decent credit and meet the Chase 5/24 rule, you should have no problem getting both simultaneously. Just remember to still apply for the Sapphire first (just in case you have any trouble getting the second card). If you do that, you would have to spend a total of $4,500 ($4,000 for Sapphire and $500 for Freedom) within three months to get each bonus.

- AFTER obtaining the bonuses for both cards, use each card ONLY in their most suitable scenarios. Use the Freedom card only for whatever the current 5% bonus category is (such as gas stations or grocery store shopping). If the purchase doesn’t fall within that category, use the Sapphire Preferred card. The Sapphire preferred card should be used for all other purchases made since it has the best point accrual rates outside of the 5% category that the Freedom has. For example, you get 2 points per dollar for travel and dining purchases with the Sapphire.

- Once again, before you make any purchase, try to evaluate whether or not the purchase can be made through either the Chase shopping portal online or through the Mileage Plus X app. At this point, it is best to use the Sapphire Preferred card in each of these types of methods.

- Every so often, go on Chase’s website, or app, to move points from the Freedom card to the Sapphire Preferred card.

- Lastly, if any friends or family are intrigued by the fact that you are traveling more and experiencing the world around you for much less money, be sure to share the love and show them the way. In doing so, make sure you use links for referral bonuses so that you also can take advantage of extra points in the process. Go to this website here or generate a link through the Chase app. Be sure that they apply through the appropriate link so that you both are actually rewarded.

- After you have accumulated a good amount of points, it’s time to book a trip. Review the example above for the steps on how to do this. For domestic flights, consider transferring to Southwest Airlines. For most international travel, consider transferring to United Airlines.

- Finally, travel and enjoy the many great experiences this world has to offer!

TRIPS I’VE TAKEN UTILIZING THIS STRATEGY

Since the start of utilizing this credit card duo, I have been lucky to book and embark on some very meaningful adventures. My first point redemption with Chase Ultimate Rewards was for a trip for two to Europe. It was always a dream of mine to take my father to Italy. After receiving the sign-up bonuses on both Chase cards above, and after utilizing the additional methods above, I was able to save up 120,000 Chase points. I transferred those to United Airlines and booked two tickets to Budapest, then Rome, and then home. I only had to pay taxes and fees which amounted to just over $100 total! This was truly a memorable experience for my father and me. Also, after another year or so of saving points, in addition to my fiance using the above strategy, we were able to pool our Chase points together for a trip of a lifetime. We transferred many Chase points to book many of the flights and hotels for our month-long honeymoon around the world! There will be more posts about these two trips soon. I can’t reiterate enough how thankful I am for realizing the existence of this strategy and this hobby in general!

FINAL THOUGHTS

By using the above guideline and strategy, you should be on your way to accumulating a large quantity of Chase Ultimate Rewards points within a short amount of time. And since these particular points are some of the most valuable out there, you will have an easier time booking your most desirable trips. At first glance, this stuff can always feel a bit confusing and overwhelming. It can also feel like too much of a hassle at times. However, once you get settled and get in the rhythm of things, I can assure you that you won’t even have to think about the process much. Ultimately, however, your new experiences will prove worthy of any and all strife!

Need more help? Try searching for your questions online. There is a lot of information out there these days about this stuff. Also, feel free to leave a comment below or send me an email at acreativetraveler@gmail.com.

If you are new to utilizing credit cards for the benefit of travel, be sure to check out my post here, which discusses the basics of everything.