The Basics of Utilizing Credit Cards for the Benefit of Travel

The world of credit card miles and points has to be one of the most lucrative industries out there. That goes for the banks as well as the consumer. When you get a credit card as a consumer, you have a decision to make. Do you take advantage of the banks or do you let them take advantage of you? If you are the type to want to be in control, the credit card game will open up a world of possibilities (literally). What is the number one complaint that people have as to why they don’t travel? Money. Most will say that traveling costs way too much money. Well, many still don’t realize that there is a very smart way to help alleviate some of those financial constraints.

My Story

After my 30th Birthday, I made a promise to myself that I would really start to up my travel game. By this point, I traveled a ton in a very short amount of time. However, there was still so much left to see and experience. After taking one glance at the over sized outline of the world on my wall, it seems like I have seen quite a bit. But the amount of un-pinned spaces still loomed over me. Although I had formulated this commitment, there was still something else that I had to consider. I knew I couldn’t lose sight of the fact that there was a future I needed to continue to save for as well. There had to be a balance. How could I make smart financial decisions for my future, but still afford to travel even more? Although I had started collecting miles/ points in a very minimal manner, I decided that this would be the time for me to really dive into the hobby.

I researched like crazy. Everyday I spent hours learning about how credit cards worked, the different ways to earn miles/ points, the different rules associated with the cards and banks, the different award programs and airline alliances they collaborate with, what goes into determining a credit score, etc. It seemed like a foreign language at first, but, like everything else in life, persistence and commitment is key. I was amazed to find out the opportunities out there, but it also made me upset that I didn’t take this more seriously a whole lot earlier in life!

The Basics

Let me start by saying that points and miles are basically synonymous. For the most part, they are interchangeable. When you receive miles, you are not receiving what you would think a traditional mile is. It doesn’t correlate to actual distance. What I mean by this is if you earn 1,000 miles, that doesn’t mean that you are now able to travel 1,000 miles. That’s not how it works so don’t get confused. They both represent a value. A value that is used like money to purchase things such as flights, hotels, gift cards, etc. (Side note: I highly recommend using them solely for travel because, in my opinion, that is where you will get serious value, financially and in regards to gaining invaluable experiences). Miles and points have different values for every airline and every hotel award program.

In the old days, the main way to earn miles was to actually take flights. This was a very slow and expensive way to earn a lot of miles. Today, there are numerous ways to rack up miles/ points, but the most efficient way is undeniably by taking advantage of credit card sign up bonuses. Most reward credit cards these days offer something in exchange for you spending a certain amount within a certain amount of time after account opening. For example, the Chase Sapphire Preferred credit card offers 50,000 bonus points after you spend $4,000 within the first 3 months of account opening. So all you have to do is meet that requirement and you are automatically given 50,000 Chase Ultimate Reward points. That is a great amount of points in such a short amount of time. You can save up points to fly economy, business class, and even first class! Imagine the feeling of flying a first class flight on a Emirates A380 airplane where you have your own private flat bed, Dom Perignon being poured at your request, fine dining meals prepared for you, and access to an in flight bar and shower room. Then imagine being able to get that simply by signing up for and using a couple credit cards. It’s a whole other world of travel that I never knew was so easily within reach for a responsible everyday consumer.

Now, it’s probably best to tell you that there are a bunch of different point programs out there. Such as, in the previous example, the Chase Ultimate Rewards Program. Each bank, each airline, and each hotel chain has their own reward program. Anyone can sign up for these online, and you should. Most people don’t realize that, at the very least, you should sign up for the programs that you use most often. A good example of this would be the mistake I made by not signing up for the Southwest Rapid Rewards program a while back. For many years, I flew Southwest flights and didn’t do the simple task of creating an account. Since each airline gives you points for each flight you take, pertaining to distance flown, I missed out on points that I would have otherwise been credited. I could have at least racked up enough for one or two free flights by the time I realized this! And this was the case for many other airlines I flew in the past as well. Ouch. It is also important to know that each program has different types of points that can be used in different ways. Some need to be used for only one affiliated company, and some can be transferred to multiple. For example, Southwest Rapid Rewards points can only be used for Southwest Airlines flights. Chase Ultimate Rewards points, on the other hand, can be transferred to a bunch of different airline and hotel brands.

It is also important to know that each airline and hotel chain has a different award chart, a chart that breaks down how many points are required to make a purchase. Let’s go back to the example of the Chase Ultimate Rewards points. After meeting the minimum and receiving the bonus, we have at least 54,000 points in that program (50,000 points from the bonus and at least 4,000 points from the spending to get that bonus). Since this program allows transferring to a bunch of different airlines, we can choose to transfer those points to the United Airlines program, called the MileagePlus program. If we look at the award chart for United Airlines (can be found online), we see that to take a round trip United flight from the USA to Europe would cost 60,000 points. So by signing up for one credit card, we almost have enough points to take a round trip flight to Europe! Another thing to note though is that the flights aren’t always 100% free. Most charge different rates of taxes and fuel surcharges. This can vary quite a bit. For example, one trip cost me only $30, while another cost me about $100. Despite this minuscule fee, you are still saving a ton on airfare costs.

Another factor that cannot be overlooked when it comes to signing up for credit cards is the fee. Some cards charge a fee directly after account opening and some waive the fee for the first year. Some cards have a re-occurring anniversary fee and some never have a fee. Typically, it’s almost always worth it to pay any initial fees due to the bonus that you will receive. For example, the Chase Sapphire Preferred card charges a initial $95 fee after opening and then at each anniversary date. When you consider the bonus that the card comes with, 50,000 points, there is still a great profit after paying the fee. You could use those points for flights that are worth close to $1,000. At around 11 months, before the anniversary fee is due, you need to evaluate whether or not it is worth it to pay the upcoming fee. If you won’t use the card enough to rack up enough points to offset the fee, or the card benefits don’t make up for the fee, then cancel. If the card doesn’t have a fee, then it benefits your credit score to keep the card as long as possible. See below for more details on this.

One of the biggest reasons a lot of people are deterred from utilizing miles and points is due to the work it takes to actually book a award. Although some programs make it easier than others, it will typically always take a decent amount of effort to find and book a award. For me, it is part of the fun. Now it is important to remember that you can’t always just book a trip when you want for the specific time you want. Award availability is limited and it is more abundant, typically, in the off peak times of year. Regardless, It’s become an exhilarating challenge. I start with an idea of what kind of trip I want, and then I research and figure out how to make that happen. I am rewarded with an awesome travel experience for a extremely discounted rate. I don’t see how anyone could not get a rush from that!

Another thing to consider is the expiration of points. Most points will expire if they aren’t used within a certain time, typically about 12-24 months. However, nowadays, most banks and award programs re-set the expiration times as long as points are accrued. There are currently many different ways to accrue points.

Options For Earning Points

- Actual flights or stays:

Every time you take a paid flight or a paid stay at a hotel (major hotel chain), you earn points for that particular program. Once again, you have to be signed up for the reward program in order for these to actually be tracked and credited. - Credit card sign up bonuses:

The most lucrative. Most credit cards offer a certain number of bonus points in return for a certain dollar amount of spending within a allotted amount of time (as discussed above) - Credit card purchases (everyday spending categories):

This is different for every card. For example, the Chase Sapphire Preferred card offers 2 points for every dollar spent travel and dining and 1 point for every dollar spent on everything else. So, obviously, it is very advantageous to use this particular card for travel and dining purchases. - Shopping portals:

Many reward programs have it’s own shopping portal. A shopping portal is just a website that links you to certain online stores. If you make purchases through that link, that reward program will give you a certain amount of points per dollar that you spend. The reason these are so valuable is because it gives you the ability to double dip on points. This is the case because the reward program that is linking you to the online store gives you a certain amount of points, but you are additionally getting points from the reward program for the credit card that you are using to make the actual purchase with. - Rental cars:

Many reward programs will give you bonus points for booking rental cars through their websites. Foe example, Southwest offers, on average, 600 bonus points when you rent a vehicle with one of the Rapids Rewards partners. - Dining programs:

Like shopping portals, most reward programs have a dining program. You sign up to these and add credit cards to an account. If you dine at one of their affiliated food/ drink establishments, you are also able to double dip. The reward program for the dining program will give you points along with the points you will get for the card that is used to pay for the dining. - Phone application:

The United MileagePlus program offers a app for your phone (MileagePlus X app) that generates gift cards for certain stores and restaurants. It charges the credit card that you put on file to generate the gift card. So, once again, you are able to double dip on points. You get points from the credit card company for the gift card purchase, and points from the United MileagePlus program for making the purchase. - Promotions:

Every now and then rewards programs will offer extra ways to earn bonus points. For example, IHG hotel group once offered prize bonus points for handwritten submissions that were mailed in to them. The rules were as follows: be a member of the rewards program, register for the promotion online, write your name, address, and rewards program number on a certain size index card, and mail each submission in its own individual envelope. The max amount of submissions was 94. Since I was in my most ambitious stages of the hobby, I patiently wrote up all 94 submissions. I had mailing address labels printed out from Office Depot, a purchase in which I double dipped in points on of course. I slapped those on along with stamps and waited. After my sore hand healed and a couple weeks went by, my email inbox received 94 emails from IHG. Each included a game with a chance to win points. If I remember correctly, I won between 40,000-50,000 bonus points from this. With these points, I was able to book a free stay at the Intercontinental in Athens, Greece. Definitely the strangest way I’ve ever received points, but it was well worth it! - Purchasing points:

Most rewards programs allow you to purchase points. The prices are different for each program and they can vary from time to time. Many times throughout the year, these programs will run sales and offer discounts for purchasing points. However, in my personal opinion, people should really try to avoid purchasing points unless it is crucial in order to book a time sensitive reward in which you barely have enough points for.

Award Routing Rules

One last thing that should be observed is that each airline also has different award routing rules. I won’t dive into this subject with too much detail, but its important to know that it is a special consideration. Most people that accumulate enough points for an award will simply book a one way (point A to B) or round trip from (from point A to B and back to A). Many people realize that there is potential to make additional stops on the same reward for the same amount of points you would normally pay. Now this is different for every airline, but taking advantage of them can really help to take full advantage of points/ miles. To give an example, let’s look at United Airlines. Let’s say that we accumulated 60,000 Chase Ultimate Rewards points and wanted to transfer them to United Airlines for a round trip to Europe. Let’s say we want to book a round trip from San Francisco to Rome with those points. We could book simply that: San Francisco to Rome and Rome back to San Francisco for 60,000 points. However, United actually allows you to fly back to your origin from a different location as long as it is in the same region as the destination. For example, you can book from San Francisco to Rome and then from Barcelona back to San Francisco for the same amount of points. In a place like Europe, it is very simple to take a train ride between Barcelona and Rome. So it enables us to see more places with the same amount of points. This is a very basic example, but some programs have rules that are way more lucrative than that.

The Effect on Credit Score

By now, I am sure you have wondering about what happens to that pesky little thing known as a credit score. Opening up a new credit card does have an effect on ones credit. When you open up a new account, it generates a hard pull and your score will drop a couple points. However, this drop is typically short lived and there are other factors that can actually help offset it a bit.

When you get a new credit card, you are given a credit limit. This is the amount that you are allowed to charge on the card. By having more available credit, you are increasing your credit utilization ratio, a major factor in determining ones score. The available credit you have versus the amount of debt you incur is the utilization ratio. So the more cards you are approved for, the higher your available credit will be. The key is not to spend more than you normally would just because you have more credit to spend. The lower you keep your debt, while increasing your credit availability, the better this ratio is. A good rule of thumb is to not keep a balance of more than 30% of your available credit limit on a card at one time.

The other factor that negatively effects your score is the average age of credit. When you sign up for a new credit card, your average age of credit will lower. However, this is also a small factor in determining ones score. The best possible way to offset this is to keep your oldest account open as long as possible. You should also keep each individual card open as long as you can. If the card has no fee, keep it forever whenever possible. If the card does have a annual fee, keep the card as long as possible, but before the next fee comes out. This is why the best rule of thumb is to evaluate a card at 11 months if it has a annual fee. 11 months is a safe time frame to give you the longest credit history with that card, while also assuring you won’t get charged a fee.

The largest factor when determining ones credit score is whether or not you pay your bills on time. Making up about 35% of your score, its impact is something you most definitely don’t want to overlook. This is why I always download the phone apps for each credit card associated bank. I link my bank account and I pay my bills often, early, and in full each month.

It is imperative to know that this hobby is not for people who have bad credit and people who have any outstanding credit card debt. If you have debt, paying that down should be your first order of business. By paying interest charges, you are letting the banks win. Also, in my opinion, it shouldn’t be for people who cannot pay their credit card bills in full each month. It is a healthy habit to always pay as early and as often as possible. The last thing you want is to rack up debt you can’t pay and end up having to pay those dreaded interest charges.

I would recommend that people don’t sign up for multiple cards unless they have a starting score of more than about 690. In my case, I signed up for 12 cards last year (2016). I have seen my credit score drop a bit at times, but I have also seen it go higher than before I started all this. As long as your credit score is high enough to begin with and you stick to these guidelines, the effect on your score shouldn’t be too much of a concern. Especially when you consider why you want a high score in the first place. Typically, scores help you get a lower interest on loans such as a home or vehicle. In my case, since my score is already fairly high, a bit of a drop won’t have much of a effect on what interest rate I get approved for. That is because a score of greater than 760 will typically get the best interest rate. The lowest I’ve seen my score is 786, still far from 760. When it comes to getting a mortgage, you should limit, or stop all together, the opening of new accounts at least a year or two before. Although you may have a perfectly good score, you don’t want lenders to think you are, in any way, a credit risk. Although there are plenty of reports from people stating it didn’t negatively effect them in such a process, I don’t think it’s worth the risk. I strategically waited until after I closed on my first home before really taking this hobby serious.

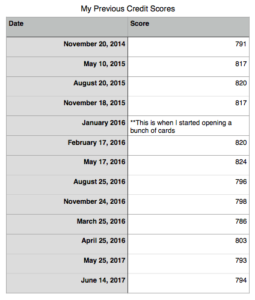

There are plenty of free ways to check your score. One of my favorites is the Mint app. Mint uses the Equifax reporting agency to check and allows me to see it once a month. My Mint scores are listed below to give you an example. Keep in mind, I sign up for two to five cards every quarter. I have closed 5 credit cards since 2015 and I currently have 12 open credit cards as of July 14, 2017.

Application Restrictions and Rules

As each day passes, banks seem to be cracking down more and more on people like me who try to really take advantage of the system. Some are even making it harder to get approved for a card if you have multiple accounts in the present and/ or in the past. For example, one of the toughest currently is Chase bank. They have a rule that is known unofficially as the 5/24 rule. If you have opened 5 or more credit cards within the last 24 months, you will be denied for most of Chases credit cards. The rules are different for every bank and they are constantly changing. Make sure to research these and have a game plan prior to applying.

Organization

A big part of making all of this work is to be diligent and stay organized. It is imperative that you keep up on paying bills on time, meeting minimum spending requirements on time, and canceling cards in the proper time to avoid fees. Without ensuring that these things maintained, an advantageous hobby could turn into a financial tragedy. For me, I found that the best way to keep track of the details is through spreadsheets that are stored on my phone. Aside from making me look like an absolute credit card nerd, being detail oriented maintains my power as a consumer. There are companies out there that help you keep track of these things, such as AwardWallet, but I started with my own spreadsheets and have gotten use to them.

Click here to see the spreadsheets I use for tracking.

Changes and Devaluations

It is very important to note that credit card offers are constantly changing and being eliminated. They come and they go, some quicker than others. None of them will last forever. One of the things I learned rather quickly was to take advantage of them before they disappear. Credit card bonuses also vary at different times throughout the year. One month a bonus might be 60,000 points for a particular card, and another month the bonus might be only 30,000 points for that same card. Its beneficial to try and sign up for the cards when the bonuses are at their peaks. Most of the time, you can easily look online to see what the historical high bonuses are for a certain card. Airline and Hotel brands are also constantly devaluing their points. Currently, a round trip flight to Europe on United costs 60,000 miles, but that could increase to 65,000 or 70,000 in the near future. And sometimes they do it without very much notice. Once again, try to always take advantage of deals that interest you as soon as it becomes feasible.

The Key To This Game

The truth in the matter is that people are throwing free money away by simply not using credit cards responsibly. By using cash, you are getting nothing in return. Credit cards should be used whenever possible, but you should never spend more than you typically would just because you want miles/ points. If you stay organized and use credit cards strategically and responsibly, you can take advantage of the banks and benefit by way of travel. Aside from significantly cutting costs on regular airfare, this hobby will also allow you to travel more luxuriously than you ever thought possible. Travel is, by far, the best personal and financial investment a person can make. To me, it is just as important as the money that I allocate to my retirement savings accounts. Therefore, utilizing credit cards in order to decrease the financial burden of travel, while also accentuating the comforts of travel, seems like a logical and advantageous strategy.