Get 2 for the Price of 1 Southwest Flights for 2 Years!

One of the absolute best travel perks out there right now is the Southwest Companion Pass. If you are able to obtain this pass, you will receive the rare ability to add a person to any Southwest flight, including its international routes, for only the cost of taxes and fees. This typically costs about $5.60 per one way domestic flight (higher for international flights). Typically, this benefit can be difficult to earn by conventional methods. However, there is a way to expedite the process of getting it, while also maximizing the time period that such a perk is granted. if done strategically, this unique benefit can last for close to two years! This is a great way to save thousands of dollars on flights and, best of all, it is a great way to really boost the amount of destinations you are able to experience.

HOW TO OBTAIN

In order to obtain a Southwest Companion Pass, you have to be a Southwest rapid Rewards member. You can do this easily by creating an account online on Southwest’s website. Once you do that, you will be given a Rapid Rewards account number and your eligible points will now be tracked in their system. The rules for obtaining the Companion Pass states that a member must acquire 110,000 Rapid Rewards points within one calendar year. The points can be obtained in a variety of different ways:

- Flying on paid Southwest flights

- Receiving a Southwest credit card sign up bonus

- Using a Southwest credit card for everyday purchases

- Shopping through Southwest’s online shopping portal

- Booking rental cars with Southwest’s partners

There also some other ways to gain points, but it is important to know that the rules state that they won’t qualify. Here are the points that do not count towards the Companion Pass:

- Points transferred from a friend or family members account

- Points transferred from an associated hotel loyalty program

- Points transferred from the Chase Ultimate Rewards program

A calendar year is defined as January 1st of a particular year to December 31st of that same year. It is very important to know that the eligible points you earn will not carry over to another calendar year. For example, if you use the above methods to obtain 62,000 Rapid Rewards points from January 1, 2017 to December 31, 2017, your available qualifying point balance will go back down to 0 on January 1, 2018. Remember, you have to earn 110,000 points within that single calendar year only. Now that doesn’t mean you will lose those points. You will still have 62,000 points in your account, but they won’t be counted towards earning the Companion Pass.

THE QUICKEST AND MOST CONVENIENT WAY TO EARN ENOUGH POINTS

Although there are a hand full of ways to earn qualifying points, there is only one way that is truly effective. That is by taking advantage of the sign up bonuses for the Southwest credit cards. Chase Bank and Southwest currently offers three products:

- Southwest Personal Plus Credit Card ($69 annual fee that is not waived the first year)

- Southwest Premier Plus Credit Card ($99 annual fee that is not waived the first year)

- Southwest Premier Business Credit Card ($99 annual fee that is not waived the first year)

At the time of writing this post (August 23, 2017), all three are offering the highest possible bonus of 60,000 points each. This means that, by signing up for only two of the three cards and meeting the minimum spending requirements, you will earn at least 125,000 Rapid Rewards (60,000 point bonus + 60,000 points bonus + 5,000 points from the spending to reach the minimums on the cards). These points, since greater than the 110,000 point threshold, will unlock the Southwest Companion Pass!

UPDATE (4/20/2018): Southwest recently changed its rules that relates to having multiple Southwest branded cards. Currently, if you sign up for one personal/ consumer Southwest card, you can not get another personal/ consumer card within 24 months. This means you will no longer be able to utilize the personal plus and the premier plus cards to achieve the Companion Pass. Going forth, you can only get one of the personal cards (plus or premier) in addition to the business card. However, it isn’t as difficult as you think to get approved for a business credit card. For the most part, if you have any secondary income or sell anything on the side (such as via Ebay), you have a good chance of getting approved. You just have to apply as sole proprietor and use your social security number as your business tax ID number. Also, remember to be truthful about every aspect of your side business (things such as revenue and years in buisness).

TIMING

One of the most crucial considerations when attempting to earn the Companion pass is timing. If timed appropriately, you have to ability to reap it’s benefits for an even greater amount of time. The rules state that the Companion Pass will remain valid for the remainder of the year in which it was earned, as well as the entire following year after that. For example, If you hit the 110,000 qualifying points in August of 2018, the pass would be good for the rest of the 2018 year as well as the entire year of 2019. In this case, you would have about 16 months with the pass. However, as you may have noticed, there is a great way to maximize the term of validity. The earlier in a year that you meet the requirements for the pass, the longer you will be given access to use it. With this in mind, the best time to sign up for the cards would be between October and December. The cards require you to meet their minimum spending requirements within 3 months. Therefore, you want to make sure that you hit the minimum spending requirement as soon as possible after January 1st of a year. As long as you hit the minimums within the month of January (or later), you will have the remainder of that year to earn the rest of the 110,000 points. That gives you plenty of time and this will ensure that the amount of qualifying points are hit as early as possible, which allows you to hold the pass for longer. If the 110,000 point threshold is hit in January, you will have the pass for at least 23 months. Here is a example of the most ideal schedule to follow:

- October 15th- sign up and get approved for 2 Southwest credit cards

- October 15th through January 1st- spend money on the cards and get close to meeting the minimum spending requirements for both cards, but be sure not to actually hit the minimums yet

- January 1st through January 15th- hit the minimums for each card

- After January 15th- earn any remaining points that you need to hit the 110,000 if you you haven’t done so by means of sign up bonuses (use any of the methods discussed above)

SOME THINGS TO CONSIDER

One thing to consider is that the sign up bonuses for each of the credit cards fluctuate fairly often. Some months they are as low as 25,000 points per card. They typically go up to 50,000 points on other months and they can go as high as 60,000 points each. It is very important to sign up for the cards when they are at the higher levels. This will make it easier and faster to hit the required 110,000 points. It is important to know that the bonuses could be very low during the ideal month to sign up, October. At that point, it may be smarter to wait until they go back up to a higher bonus a couple months or so later. For example, If the bonuses on the cards are at only 25,000 points in October, you may want to wait until January or February (or later) when they go up to at least 50,000 points. This is because, as previously discussed, the sign up bonuses are the most effective way to earn the pass. It would take a lot of flying and spending to earn the remaining points needed if the bonuses are at a low rate. In my opinion, it is more beneficial to spend less time and money earning the points than it is to focus primarily on getting it at the most ideal time. If the cards bonuses are at their historical highs (60,000 points), you can easily earn the pass simply by signing up and utilizing only two Southwest cards. And you should be able to get approved for both simultaneously to make things even easier. If you do that, however, be sure that you are able to meet both minimum spend requirements simultaneously as well. That is definitely the most effective route if you are able to.

Another major consideration when trying to get a Southwest Companion Pass is that you have to think about the Chase 5/24 rule. I have discussed this briefly in a previous post (click here to read more about it). Since Chase bank is the provider of all of the Southwest credit cards, their application rules are in effect. The rule currently states that if you have opened five or more credit cards within the past twenty four months, you will not be approved for any of the Southwest cards available. If you are unsure as to whether or not you fall under this criteria, be sure to check your credit report. For example, if you are trying to get approved for two of the Southwest cards, you have to be sure that you haven’t opened any more than 2 credit cards in the last 24 months. If so, you most likely won’t get approved for both cards. Obviously, this can be a vital deciding factor for some.

THE STRATEGY I USED TO RECEIVE THE SOUTHWEST COMPANION PASS

At the time when I got my Southwest Companion Pass, there was actually an additional route to obtain the qualifying points. There was a time when you could transfer hotel points, from certain programs, to Southwest and they would be counted towards the 110,000. It opened up a couple more effective routes to quickly and easily unlock this valuable benefit. Since Marriott hotels was one of the possible transfer partners, I decided to utilize them. Marriott was offering 80,000 bonus points on their main personal credit card. I signed up for it and had my fiancée do the same. After meeting the minimums, I had my fiancée transfer a large portion of her Marriott points to my account. Then I transferred enough Marriott points from my account to Southwest and received 50,000 Rapid Rewards points, which counted towards the Companion Pass. I also signed up for the premier Southwest Credit Card and received a bonus of 50,000 qualifying points. For the remaining points needed, I made all of my purchases through the Southwest shopping portal using my Southwest Premier credit card. That, along with some points from taking Southwest flights, got me to the 110,000 points I needed. It would have been better, and easier, to just sign up for two Southwest cards on my own, but, at the time, I already had a couple Chase cards and I wasn’t sure whether or not they would allow me to have a second Southwest card. I received the Companion Pass in March of 2016 and received it for a 22 month term.

AFTER EARNING AND HOW TO USE

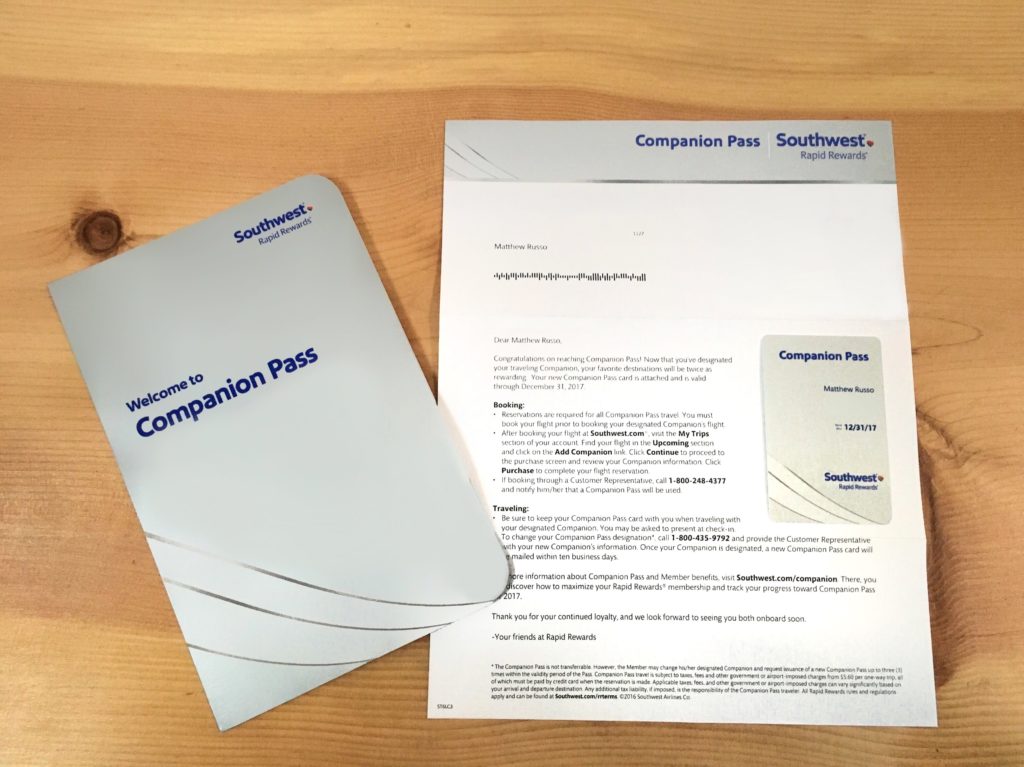

If you are able to reach the 110,000 point threshold, you will be granted a Companion Pass. Your online Rapids Rewards account will now confirm eligibility. After logging into your account, you will be able to designate your first companion. You can choose anyone you want, but they must also have a Rapid rewards account at the time of assignment. At this time, you should then receive a letter and card in the mail stating your eligibility along with the companion confirmation. You are allowed to change your designated companion a maximum of three times per calendar year. Once again, a calendar year is described as the time period between January 1st of a year through December 31st of that same year. This means that in two calendar years of having the Companion Pass, you can assign seven different people as your companion (the original designation and then 3 changes for each of the 2 years with the pass). Otherwise, you can do like I did and alternate between one main companion (my fiancée) and other friends and family members.

After you earn the companion Pass, you will have a minimum of 110,000 Rapid Rewards points in your account. It is important to remember that these are all still yours to use in addition to the pass! That is a lot of points! To put this in perspective, a flight that originally costs around $99 will typically cost around 5,600 points. It is also important to know that you can also add a companion to a flight that you book with points. You don’t have to pay cash for a flight in order to add a companion. For example, if you find a flight from Las Vegas to San Francisco for $99, you could choose to use points to book that flight. This would cost around 5,600 points and $5.60 for taxes and fees. After you book the flight, you go online to your account and add your companion to your itinerary. You will also have to pay an additional $5.60 for the taxes and fees for your companion. In this example, this flight would cost only $11.20 for two people! Imagine how many flights you can take at this rate using that amount of points! When you run out of points, you can pay cash for a ticket and add a companion for as many times as you want within your designated eligibility range. Depending on how you want to look at it, this would equate to getting two flights for the price of one or getting two flights for half off of the original price (considering that your companion would give you half of the money for the flight that you booked in your name with cash).

**Pro Tip: Someone else can book a flight for you using cash or points and you can still add a companion. For example, if you run out of points, you can also have a friend or family member book you a flight with their points. After they do that, you can go into your online account and add them as a companion.

MY ACCUMULATED DESTINATIONS THUS FAR

I currently have about 4 months left to use my companion pass. Within the last couple years, I have gotten a ton of value from this. I have visited Las Vegas (multiple times), Los Angeles (multiple times), Seattle, Portland (multiple times), Boston, New York City (multiple times), Fort Lauderdale, Miami, Havana, and Puerto Vallarta. All of these flights were with a companion and almost all were booked using the Rapid Rewards points that I accumulated to get the pass. I used hardly any cash to take all of these flights. With that in mind, this is undoubtedly the best travel benefit that I have ever had in all of my years of traveling. To see a good example of a trip that was made possible by the Companion Pass, check out my other post Cousins In Cuba (2 Free Roundtrip Flights).

CONCLUSION

Southwest is one of the best airlines in the United States for domestic travel. They are also opening up more and more international routes each year. They currently offer: Cuba, Mexico, Bahamas, Belize, Jamaica, Puerto Rico, Costa Rica, etc. The Southwest Companion Pass allows you to add a companion to any flight for only the low cost of taxes and fees. By using the Rapid Reward points you earned to get the pass, many flights would be close to free. Also, if you time it right, you can take advantage of this rare perk for close to two years with up to seven different designated companions. After having a Companion Pass for about 18 months now, I can honestly say that it is completely worth the effort it takes to get it. I have saved a ton of money on travel and I have gotten to visit a bunch of places that I otherwise wouldn’t have in such a short amount of time. As I have said before, travel deals such as this come and go. Take advantage of them while they are still around. This is one of those opportunities that will be gone in an instant. One day, we will all look back and long for the time that such a benefit existed. So put a plan into action and start thinking about all of the places you would go and all of the people that you would take with you!

If you are new to using credit card miles and points for travel, be sure to read my other post where I discuss everything that you need to know to get started. Click here to read The Basics of Utilizing Credit Cards For the Benefit of Travel.